Oil Production 2030

Team Members

- Mihai Andreoiu

- Michael Aouad

- Joost d'Hooghe

- Phil Poetter

- Shirley Yuen

Scenarios

Following are the 4 scenarios that have been developed for 'oil production 2030':

The world continued its economic growth into the second and third decade of the 21st century, with the main engines being the emerging markets, spearheaded by China and India. The latter especially experienced leapfrog industrialization. History is written as “Business as usual”, as trends of previous decades consolidated. While the center of economic gravity had been steadily shifting, western countries supported the growth of emerging markets as they were huge consumer markets. Global population growth maintained its leveling-off trend and marginally declined to 1.3% p.a., resulting in 9 billion by 2030. Considering that the lion share of growth took place in emerging markets that had started off from a fractional energy (oil) consumption basis, economic development which stood at the bottom inflection point (see S-shape growth curve) in these countries drove the near exponential consumption growth. The latter only showed signs of reduction in the second half of the third decade. Energy efficiency made considerable progress in line with joined multi-lateral efforts to support and incentivise R&D in the public and private sector. While the G20 were driving most talks, getting all emerging nations on board was one of the primary objectives. The quite differing national and/or geographical interests, however, repeatedly represented contentious points and often lead to having a ‘spanner in the works’ when multi-national agreements were sought. Despite global efforts to replace fossil fuel (oil) consumption, especially the strongly growing private transport sector lead to total demand continuing to outstrip supply. The reason was two-fold: the continued lack of wide-spread secondary infrastructure (e.g. stations where vehicles can be charged with alternative(ly generated) energy and the additional (switching) cost to the public sector and individuals – ultimately a result of economically viability (that varies drastically across the globe). As a result, emerging markets became the prime consumer of crude oil.

With the renewed wave of economic growth of emerging countries after 2010 and their subsequent need for oil, substantial power resides with National Oil Companies (NOCs) where reserves are located. Bilateral deals between producing countries (mainly OPEC) and emerging countries become the norm; often associated with oil for technology trades. Besides mere economic reasons, oil is provided not only for international currencies but also for show ideological support (e.g. as demonstrated in Venezuela, where Hugo Chavez rules the “new Cuba”). Overall, the 600 billion barrel conventional oil reserve estimated in 2010 decline steadily, while non-conventional oil plays (i.e. tar sands in Canada or ‘heavy oils’ in Venezuela) become more viable as they are exploited more systematically. In 2015, additional reserves were estimated at 3 trillion barrels of (un)conventional oil, subsequently revised upward considering further increases in recovery rates (to 45%) due to further advances in extraction and production technology. Peak oil has not happened and global daily oil production is up from 80mbpd in 2010 and reached the 120 mbpd mark in 2030.

With the continued increase in oil demand and diminished conventional oil reserves as well as higher-cost unconventional oil, crude price rocketed to USD 300 per barrel in 2020, thus allowing for more spending towards non-conventional oil R&D and investment into E&P. Despite the often written off ‘oil industry’ and its reputation far below par compared to other sectors that lead to the dooming ‘crew change’ problem, high oil dollars continue to draw (younger) people into the industry – though limited to producing companies. The latter started to take full charge of their natural deposits and equally localized their talent pool which in turn made them more independent of previously needed western expertise and increased their selling power on global commodity markets. By 2015, ‘global warming’ became one of the most discussed topics at global leaders’ forums. To curb emissions, underground “cap and store” solutions (carbon sequestration) were considered a reasonable technique to contain CO2 as one of the believed green house gases. This however, was merely limited to single-source CO2 emitters (power plants). Due to its higher CO2 content, unconventional oil was overweight in power generation. Having been rolled out in most of industrialized and emerging countries by 2020, this technique was planned to be in place until oil can be fully phased out as an economically needed resource.

2) Change of Guards

The world characterized by the "Change of Guards" is at a turning point. Sequel to previous forums in Kyoto and Copenhagen, multi-lateral engagements on the international political scene have unfolded and have had a lasting impact. Environmental pressures have been going hand in hand with an increasingly stiffening geopolitical landscape. Discussions on key issues - mainly related to global warming and its arguably strong correlation to CO2 emissions by fossil fuels - have been fierce, but constructive. It became increasingly clear that a strong mandate and commitment were required to move forward. As a result far-reaching regulations with binding agreements have been put in place, paving the way for a joint effort of the G20.

All this has come at a time, when the world has been continuing its economic growth, while population growth (at 0.8% annually) started leveling off sooner than anticipated, leading to a world population just shy of 8 billion in 2030; +17% compared to 2010 levels. Still, total global energy demand has increased by twice as much in line with economic development in populous emerging markets.

Increased efforts at R&D level have led to energy efficiency gains quickly outstripping increases in global energy demand. Strong governmental support has been reflected by putting in place the required infrastructure for large-scale alternative energy coverage and required production capacities.

Oil peak occurred a few years just before the turn of the decade. In 2015, ongoing discussion on reserve figures led to a reevaluation after which OPEC countries had to adjust their figures significantly downward. From then on, oil reserves started depleting at an increasingly fast rate from a maximum of 1.3 trillion barrels and are expected to dwindle down to 100 billion barrels in 2030. While non-conventional oil resources are not economically viable to exploit, ongoing production cannot replace dwindling production rates. Globally, most wells are in their final stage of their life cycle.

With the financial competitiveness and increasing availability of alternative energy sources not only in advanced but also emerging markets, oil prices have started started a continuous decline. The much anticipated scarcity of skilled labor in the oil industry failed to appear as decreasing operating activity could be covered by the existing pool of people and productivity gains. Moreover, the Middle East and parts of Central and South America have become the main centers of oil production as the focus has shifted towards easily accessible and cheap oil.

The oil-age is coming to an end - the age of alternative energies is in full swing.

3) Too little - too late

For over 20 years now the world economy has continued to decline, countries have generally turned into protectionist mode with limited trading with long term allies at their geographic borders. The international cooperation initiatives such as NATO have lost their meaning and everywhere stronger nationalistic activism is present. There is a strong polarization between West and East, generally split by Christian and Muslim religion. The growth in former emerging markets such as Brazil and India has halted as these emerging markets economies where very dependent on international trade which has continued to lag given the more restrictive trade policies of the old economies.

The world population has grown to 9 billion driven by poverty especially in emerging markets, with a potential additional 1 billion people in Asia and Africa.

The global warming has reached an all time high, the average global temperature increase of 1,1 degrees compared to 2000, that was measured in 2015, has now doubled. Big international conferences regarding climate policies have continued to fail producing agreements and countries have not been willing to work together to solve climate issues or invest sufficiently into alternative energy sources. Global warming issues have become increasingly worse and people had to seek refuge to different countries. The climate refugees have started causing more economic problems and are causing continued economic recession and political instability.

In 2030, there are no conventional oil reserves left. In contradiction with earlier estimates Peak Oil happened years ago. After official corrections of existing reserves and a collapse of the OPEC cooperation the estimates continued to be adjusted downwards. In the past years major oil companies and countries were not aware or in denial resulting in a unstabile oil supply and a structural shortage of new found exploration sites. Oil production concentrated on conventional sources and little investments were made in the exploration efficiency. Oil price decreased to USD 60 a barrel by 2020 and was still going down due to a second wave of economic recession. The industry crew change has been continuously getting worse as oil prices remain low, over the past 20 years people were not interested to join oil companies, thus the oil industry has been in a continued downwards cycle. By 2025, the industry finally acknowledged that Peak Oil had happened and that the conventional oil resources were almost depleted. The price of oil by then skyrocketted to USD 300 a barrel. Due to these tremendously high prices of oil, oil companies started offering exorbitant bonuses and so they were able to attract people to work in the oil industry again, but as it takes time to train people, and the shortage of qualified people continued, the price of oil moved even higher in the next years. Non-conventional oil exploration has intensified in a desperate effort to provide the much needed resource. Although there have been some new finds, due to the slow start, non-conventional oil, alternative energy and more efficient use of energy are not sufficient to replace the conventional oil resources.

In 2030 due to the shortage of energy,transportation has become prohibitive. Trade and business continue to lag. The Recession is worsensing, creating political instability within countries as there is a bigger delta between poor and rich. Regional issues between West and East, Christians and Muslims are worsening and terrorist attacks are the order of the day. Economies remain in an extended recession and the world is aware that too little has been done to late.

4) N@NO

The global population has continued to increase in size up to 9 billion by 2030. The economy has recovered from the economic crisis and energy demand had steadily increaed. The majority of energy use is now for transportation and in specific for road transportation. The improved virtual technology provided a realistic alternative to face to face contact. However, the distance traveled and number of travelers still increased resulting in an increase of total road transportation. Due to the increased investments into alternative energies in 2015 a stream of enabling technologies became available supporting the full scale use of electrical cars.

A first key breakthrough was the third generation derivative of the thin-layered paint-able Nano-solar technology. As a result the electricity required to “fuel” the increasing number of electrical cars has become available. For many years the main barrier to move from the now common hybrids to full electrical cars has been the required battery capacity. Finally in 2019 the “biobattery” became industrially feasible. The technology was initially developed by the Texas Univeristy in Austin in 2003; the device produces electric energy owing to the same glucose oxidation reaction that occurs in the human body.

As a result of the move towards the full electrical cars, there is now a reduced demand for oil. Between 2010 and 2019 the annual oil production increased from 80 to 90 billion barrels, the price has followed the same gradual increase and oil traded at around 100 $ per barrel. Especially in dense areas and developed countries like the US East Coast, Europe and Japan the electrical grid became fully realized by 2025. The global oil demand has been dramatically impacted by this move and apart from some 40 million oil fuelled cars in Africa, India and South America the main use of oil has switched to plastics, fertilisers and the pharmaceutical industry.

By 2030, oil production has decreased to 30 billion per year and oil price has decreased to less than $ 30 US per barrel. Less money is now spent in the oil sector as further exploration and technology advancement is no longer required as the conventional reserves appear to be enough to satisfy demand for quite some time. The continuing improvements of the "biobattery" technology will allow the move to electrical cars in the sun rich areas that still use petrol engines in the next decade. The crew change problem has ceased to exist as there is now much less demand for qualified and experienced personnel.

New Driving Forces

- World population growth

- Open decentralized electricity networks

- Continental Protectionism

- Growth of developing markets

- OPEC's Role

- Remaining Oil Reserves

- Environmental Impact

- Global Warming

- Renewable sources of energy

- Coal Seam Gas

- Drilling Technology

- Increasing Efficiency in Energy Use

- Increase of International Cooperation in Energy Policy

- Proliferation of extremist / dictatorial regimes

Edited Driving Forces

Research Questions

- Will strong political and religious agendas reflect in 'oil politics'?

- Oil, as a strategic asset as well as an energy source. Will there be global political alliances between oil producing and non-producing countries?

- Has OPEC gotten its act together in order to tighten control on oil supplies?

- Will there be strong global government regulations regarding fossil fuel usage?

- How successfull have international agreements (e.g. Kyoto Protocol) been in decreasing energy use?

- How is the world economy developing?

- How is the economy in the emerging markets developing? are they going through the same industrailization process like developed countries?

- Are renewable energy sources economically viable?

- Will consumers demand green energy supply due to ongoing global warming?

- Will the growth of the population continue till 2030?

- Do oil (and gas) continue to be the major source of energy?

- Will the global energy consumption decrease due to improvements in more efficient use of energy?

- What are the chances of finding oil in not yet explored locations such as deep see regions?

- Will improvement in drilling technology increase the oil production?

- What are the alternative energy sources?

- Will changes in mobility change the use of energy?

Research Topics

- Oil Production

- Oil and Global Warming

- The Big Crew Change

- Peak Oil

- Efficiency in energy usage

- Energy Demand

- New Finds

- Geopolitics

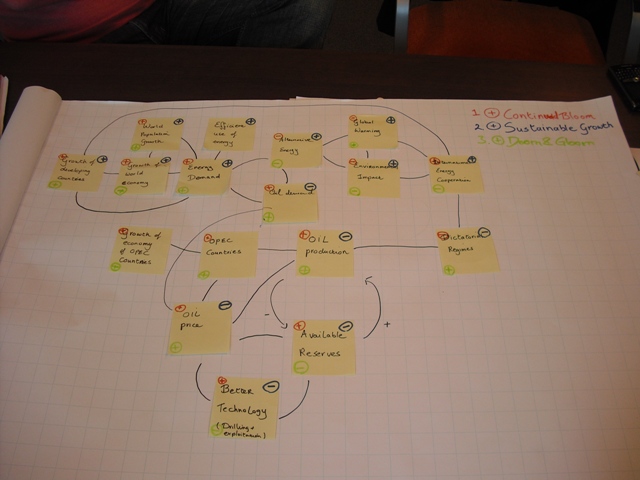

Systems diagram

First draft systems diagram

Second draft systems diagram

Third draft using mind map

Resources

- BP - Oil reserves / Statistics 2008

- Booz&co - The Upstream Survivors 2009

- European Central Bank - Assessing the factors behind oil price changes / Working Paper Series; Jan-2008

- Global oil reserves and fossil fuel consumption

- International Energy Agency - Oil Market Report

- Renewables Global Status Report 2009 update

- Shell Scenarios

- Schlumberger

- Schlumberger - Andrew Gould at Simmons & Company International European Investor Conference

- Schlumberger - Highlighting Heavy Oil

- Simmons & Company International - Do Fossil Fuels have a sustainable future?

- Simmons & Company International - Speeches and papers

- United Nations University - different scenarios and research on global warming and the global energy outlook till 2030

- International Energy Agency - oil production in 2030 outlook