Scenario BBB

Biotechnology for Medical Applications in 2015 - Scenario BBB: Biotech Bubble Burst

Maybe it was the recent memory of the dot.com rise and fall that eventually led to the dramatic and turbulent changes in the biotech industry. In any case it had many similarities. In the early years of the 21st century, the biotech industry could look back on a period of 20 years with growth rates of around 20%. The total market capitalization of the Biotech industry was more than $300 billion in 2005.

2005 was followed by difficult years for the biotech industry. Transfer of fundamental research into applications was much more complex than expected and development cost exceeded expectations by far. Also, both FDA and EMEA got much stricter in their approval practices and in monitoring drugs, after several spectacular cases where drugs had to be withdrawn from the market (the most spectacular cases were VioX and Tysabri). The negative impact on industry reputation triggered by these withdrawals was much more dramatic than in earlier years. These may have been the main reasons that explain why the industry failed to bring any new blockbuster drugs to the market.

At the same time, a number of privately funded biotech companies, untouched by official regulations, announced that they were pursuing experiments with human cloning, media attention and public reactions increased dramatically. People, especially religious movements in the US, began demonstrating and received a vast amount of media attention as a result. The focus of the demonstrations were not directly related to details and potential hazards of stem cell research, but instead more focused on the potential horrors of cloning as well as on abortion issues. The situation eventually worsened, when information and pictures appeared of failed cloning experiments involving human embryos. Most of the global (and national) ethnic and regulatory bodies in the world were in uproar and demanded a complete stop of human cloning R&D, huge penalties to the companies involved and imprisonment of the responsible managers and researchers. The media also worsened the situation by “sensationalism” journalism, increasing the fear in the public and increasing the pressure on politicians to address the problems.

After the uproar that followed the unsuccessful cloning experiments, biotech regulation had clearly become a hot political topic. Most developed nations started to impose laws on biotech R&D and detailed monitoring mechanisms were adapted to prevent further “unethical” and “dangerous” development projects in the future. The imposed restrictions led to a draining of the capital that had been the foundation of the successful growth in the biotech industry up to 2010. Governments saw themselves forced to cut R&D spending on biotech projects, because of pressure from the lobbying of ethical and religious groups and from the increasing media attention. The lack of financial governmental support also caused the venture capital industry to turn their backs on the biotech industry. The fact that venture capitalists started to look elsewhere was also the result of the many new and exciting “hot” industries that started to emerge around 2010 (e.g. nanotechnology). Furthermore, the first years after 2010 saw again a downturn in the economy, which caused further drainage of funding sources. This situation forced most biotech companies to focus on a few “money generating” products, and the aggressive R&D projects which were attractive to investors were no longer feasible for most companies due to financial constraints. As a result, more and more biotech companies were forced into liquidation, and many were desperately seeking buyers (many comments were made to the analogy of the dot.com situation in the early years of the millennium). The biotech industry went through a dramatic consolidation. Eventually, in 2015, the total market cap of the biotech industry was merely 250 billion $. The few successful biotech companies that had survived the industry downturn had seen their stock prices tumble, and most were taken over by major traditional medical companies. The biotech industry was no longer what it once had been.

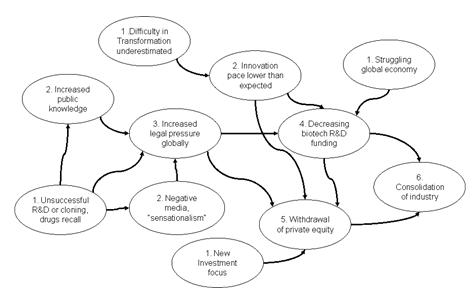

Scenario Diagram

Click for larger image:Biotech Bubble Burst - Scenario Diagram