Difference between revisions of "Oil Production 2030"

| (141 intermediate revisions by 15 users not shown) | |||

| Line 1: | Line 1: | ||

__TOC__ | __TOC__ | ||

[[Image:Amuay-Cardon Oil Refinery.jpg|thumb|The Amuay-Cardon Oil Refinery, Venezuela]] | |||

[[Image:Kuwait oil fires.jpg|thumb|Burning Oil Fields, Kuwait]] | |||

[[Image:FPSO TAKUNTA.jpg|thumb|Floating Production, Storage and Offloading (FPSO) Takunta]] | |||

<i>This page contains scenarios about oil production in 2030.</i> | |||

==Team Members== | ==Team Members== | ||

<ul> | <ul> | ||

| Line 10: | Line 13: | ||

</ul> | </ul> | ||

==Driving Forces== | ==Introduction== | ||

*[[ | During our Scenario Thinking class we explored the future scenarios of "Oil Production in 2030". The main goal was to come up with a set of scenarios that are useful for strategic thinking at oil industry servicing companies. | ||

In our diverse team we had the opportunity to look at the issue from different angles, both with an industry background as well as outsider opinions. We also engaged with industry experts such as commodity traders and energy sector professionals. | |||

The result of our project is a set of 4 scenarios, ranging from a scenario "in line" with the general industry gospel as well as more stretched assumptions such as "N@NO" and "Too little too late". | |||

We have enjoyed exporing the future and hope the scenarios below will help others to prepare for the unknown. | |||

Mihai, Michael, Shirley, Phil, Joost | |||

==Scenarios== | |||

Following are the 4 scenarios that have been developed for 'Oil Production 2030': | |||

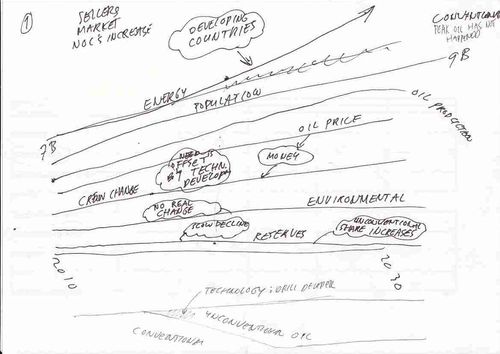

===1) Business as usual=== | |||

[[Image:Oil Production 2030 - 001 - Business as usual.jpg|500px|center]] | |||

The world continued its economic growth into the second and third decade of the 21st century, with the main engines being the emerging markets spearheaded by China and India. The latter in particular experienced leapfrog industrialization. | |||

History is written as “Business as usual” as trends of previous decades consolidated. While the center of economic gravity had been steadily shifting, western countries supported the [[Growth of developing markets| growth of emerging markets]] as they were huge consumer markets. [[World population growth|Global population growth]] maintained its leveling-off trend and marginally declined to 1.3% p.a., resulting in 9 billion by 2030. Considering that the lion share of growth took place in emerging markets that had started off from a fractional energy (oil) consumption basis, economic development which stood at the bottom inflection point (see S-shape growth curve) in these countries drove the near exponential consumption growth. The latter only showed signs of reduction in the second half of the third decade. | |||

[[Increasing Efficiency in Energy Use|Energy efficiency]] made considerable progress in line with joint multi-lateral efforts to support and incentivise research and development in the public and private sector. The G20 were driving most talks and getting all emerging nations on board was one of the primary objectives. Differing national and geographical interests repeatedly represented contentious points and often lead to having a ‘spanner in the works’ when multi-national agreements were sought. | |||

Despite global efforts to replace fossil fuel (oil) consumption the strongly growing private transport sector lead to total demand continuing to outstrip supply. The reason was two-fold: the continued lack of wide-spread secondary infrastructure (e.g. stations where vehicles can be charged with alternatively generated energy); and the additional (switching) cost to the public sector and individuals (ultimately a result of economically viability that varies drastically across the globe). As a result emerging markets became the prime consumers of crude oil. | |||

With the renewed wave of economic growth in emerging countries after 2010 and their subsequent need for oil, substantial power resides with National Oil Companies (NOCs) where reserves are located. Bilateral deals between producing countries (mainly OPEC) and emerging countries become the norm; often associated with oil for technology trades. In addition to economic reasons, oil is traded not only for international currencies but also for show ideological support (as demonstrated in Venezuela where Hugo Chavez rules the "new Cuba"). | |||

Overall the 600 billion barrel conventional oil reserve estimated in 2010 declined steadily, while non-conventional oil plays (i.e. tar sands in Canada and "heavy oils" in Venezuela) become more viable as they were exploited more systematically. In 2015 additional reserves were estimated at 3 trillion barrels of (un)conventional oil subsequently revised upward considering further increases in recovery rates (to 45%) due to advances in [[Drilling Technology|extraction and production technology]]. [[Peak Oil|'Peak oil']] has not happened and global daily oil production is up from 80mbpd in 2010 to the 120 mbpd mark in 2030. | |||

With the continued increase in oil demand and diminished conventional oil reserves, as well as higher-cost unconventional oil, crude price rocketed to $300 per barrel in 2020, allowing for more spending towards non-conventional oil R&D and investment into E&P. Despite the often written off "oil industry" and its reputation far below par compared to other sectors that lead to the dooming [[The Big Crew Change|"crew change"]] problem, high oil dollars continue to draw (younger) people into the industry – though mainly to producing companies. The latter started to take full charge of their natural deposits and equally localized their talent pool which in turn made them more independent of previously needed western expertise and increased their selling power on global commodity markets. | |||

By 2015 [[Global Warming|"global warming"]] became one of the most discussed topics at global forums. To curb emissions underground "cap and store" solutions (carbon sequestration) were considered a reasonable technique to contain CO2. However this was limited to single-source CO2 emitters (power plants). Due to its higher CO2 content, unconventional oil was overweight in power generation. Having been rolled out in most of industrialised and emerging countries by 2020, this technique was planned to be in place until oil can be fully phased out as an economically needed resource. | |||

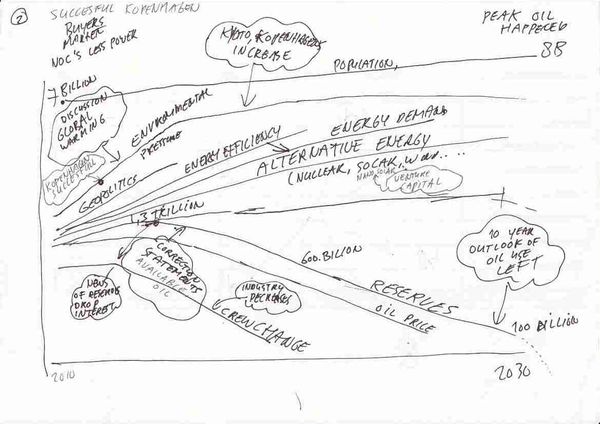

===2) Changing of the Guards=== | |||

[[Image:Oil Production 2030 - 002 - Changing of the Guards.jpg|600px|center]] | |||

2030: The oil-age is coming to an end - the age of alternative energies is in full swing. | |||

Sequel to previous summits in Rio de Janeiro (1992), Kyoto (1997) and Copenhagen (2009), [[Increase of International Cooperation in Energy Policy|multi-lateral engagements]] on the international political scene unfolded and created a momentum that had a lasting impact into the 2nd and third decade of the 21st century. Environmental pressures have been going hand in hand with an increasingly stiffening geopolitical landscape. Discussions on key issues - mainly related to CO2 emission caps by fossil fuels (including oil) and its [[Oil and Global Warming|arguably strong correlation to global warming]] - have been fierce, but constructive. It became increasingly clear that a strong mandate and commitment were required to move forward. Eventually it took the joint effort of the G20 to threaten the USA (at the time by far the largest CO2 emitter by capita) with an economic export-sanction until the USA ratified the treaty in 2014. This eventually marked the turning point for the non-binding ‘Washington Declaration’ that had been in place until then, as far-reaching regulations with binding agreements had to be put in place within each country to achieve the set goals. Furthermore a plan to assist China and India in implementing CO2 reducing measures and thereby averting the looming super-emitter, was put in place. | |||

All this came at a time when the world had been continuing its economic growth and while [[World population growth|population growth]] (at 0.8% annually) started leveling off by 2015, sooner than anticipated. The world population is just shy of 8 billion in 2030; +17% compared to 2010 levels. Total global [[Energy Demand|energy demand]] doubled in line with economic development in populous emerging markets. | |||

Increased efforts in research and development led to [[Efficiency in energy usage|energy efficiency]] gains quickly outstripping increases in global energy demand. Strong governmental support has assited the putting in place of the required infrastructure for [[Shift to Alternative Energy Sources|large-scale alternative energy]] coverage and required production capacities. | |||

After [[Peak Oil|‘Peak Oil’]] occurred a few years before the turn of the first decade, in 2015, ongoing discussion on reserve figures led to a re-evaluation after which [[OPEC's Role|OPEC]] countries had to adjust their figures significantly downward. From then on oil reserves started depleting at an increasingly fast rate from a maximum of 1.3 trillion barrels to approximately 100 billion barrels in 2030. While non-conventional oil resources are not economically viable to exploit, ongoing production cannot replace dwindling supply. Globally, most wells are in the final stage of their life cycle. | |||

Beyond 2010, but notably after 2015 when the emission treaty took effect, policy changes fundamentally impacted the clean, but even more so, alternative energy landscape. Economic drivers and increasing availability of alternative energy sources in advanced and emerging markets lead to a steady replacement of previously oil-generated energy, leading to a steady decline in oil price. Similarly the much anticipated [[The Big Crew Change|scarcity of skilled labor]] in the oil industry failed to appear as decreasing operating activity could be covered by the existing pool of people and productivity gains. Moreover the Middle East and parts of Central / South America as well as the Caspian Region had become the sole centers of oil production as the focus shifted towards easily accessible and cheap oil in politically stable countries. Despite substantial reserves of high-grade crude, West Africa dropped out of the list as continued security concerns represented too much a risk for foreign investors to bear going forward. | |||

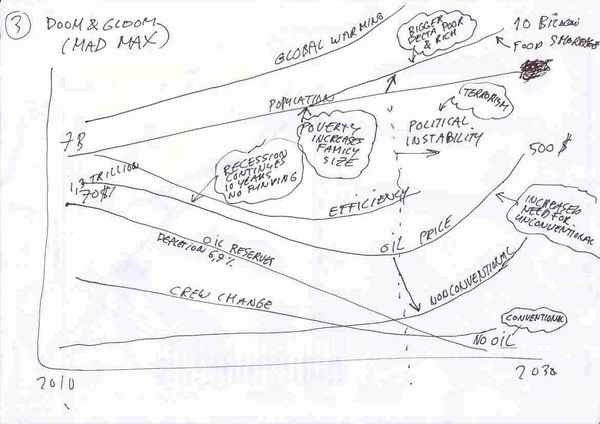

===3) Too little - Too late=== | |||

[[Image:Oil Production 2030 - 003 - too little too late.jpg|600px|center]] | |||

For over 20 years now the world economy has continued to decline; countries have reverted to protectionist practices and limited trading to long term allies at their geographic borders. The international cooperation initiatives such as NATO have lost their meaning and everywhere stronger nationalistic activism is present. There is a strong polarization between West and East, generally split along religious lines. The growth in former emerging markets such as Brazil and India halted as these emerging markets economies were very dependent on international trade which has continued to lag given the more restrictive trade policies of the old economies. | |||

The [[World population growth|world population]] has grown to 9 billion driven especially by poverty in emerging markets, with a potential additional 1 billion people in Asia and Africa. | |||

[[Global Warming|Global warming]] reached an all time high, the average global temperature increase of 1.1 degrees from 2010 to 2015, has since doubled. International conferences regarding climate policies have continued to fail to produce agreements and countries have been unwilling to work together to solve climate issues or invest sufficiently in alternative energy. Global warming issues have become increasingly worse and parts of the world population have had to seek refuge in different countries. The climate refugees have caused economic problems which is leading to sustained economic recession and political instability. | |||

In 2030 there are no conventional oil reserves left. In contradiction with earlier estimates [[Peak Oil|Peak Oil]] happened many years ago. After official corrections of existing reserves and a collapse of [[OPEC's Role|OPEC]] cooperation the estimates continued to be adjusted downwards. In the past years major oil companies and countries were not aware of, or in denial of the peak resulting in an unstable oil supply and a structural shortage of new found exploration sites. Oil production concentrated on conventional sources and little investments were made in exploration efficiency. The oil price decreased to $60 a barrel by 2020 and was still going down due to a second wave of economic recession. The [[The Big Crew Change|industry crew]] problem change continued to worsen as oil prices remained low, over the past 20 years people were not interested in joining oil companies, thus the oil industry has continued in a downward cycle. | |||

By 2025 the industry finally acknowledged that Peak Oil had happened and that the conventional oil resources were almost depleted. The price of oil skyrocketted to $300 a barrel. Due to tremendously high prices of oil, oil companies started offering exorbitant bonuses and were able to attract people to work in the oil industry again. However due to the time needed to adequately train staff, and the continued shortage of qualified people, the price of oil moved even higher in the next years. Non-conventional oil exploration intensified in a desperate effort to provide the much needed resource. Although there have been some [[New Finds|new finds]], due to the slow start, non-conventional oil, [[Shift to Alternative Energy Sources|alternative energies]] and more [[Efficiency in energy usage|efficient use of energy]] are not sufficient to replace the conventional oil resources. | |||

In 2030 due to the shortage of energy, transportation has become prohibitive. Trade and business continue to lag. The recession is worsening, creating political instability within countries as the chasm between rich and poor widens. Regional issues between West and East are worsening and terrorist attacks are the order of the day. Economies remain in an extended recession and the world is aware that too little has been done to late. | |||

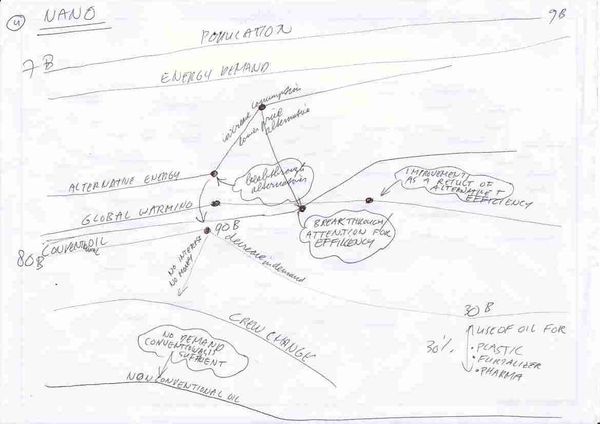

===4) N@NO=== | |||

[[Image:Oil Production 2030 - 004 - Nano.jpg|600px|center]] | |||

It is 2030 and oil production has decreased to 30 billion barrels per year; the oil price loiters around $30 per barrel. Less money is spent in the oil sector as further exploration and technology advancement are no longer required - the conventional reserves appear to be enough to satisfy demand for quite some time. The continuing improvements in "biobattery" technology will allow the move to electrical cars in the sun rich areas that still use petrol engines over the next decade. The oil industry crew change problem has ceased to exist as there is now much less demand for qualified and experienced oil field personnel. The [[World population growth|global population]] is currently around 9 billion. | |||

In 2010 the economy recovered from the economic crisis and [[Energy Demand|energy demand]] steadily increased. The majority of energy use was for transportation, and specifically for road transportation. Though improved virtual technology provided a realistic alternative for face-to-face contact the distance traveled and number of travelers increased, resulting in an overall [[Increasing Mobility|increase in demand for road transportation]]. Due to an increased investment in [[Shift to Alternative Energy Sources|alternative energies]] in 2015 a stream of enabling technologies became available, supporting full scale use of electrical cars. | |||

The first key breakthrough was the third generation derivative of the thin-layered paint-able Nano-solar technology. As a result the electricity required to "fuel" the increasing number of electrical cars became available. For many years the main barrier to move from the now common hybrids to full electrical cars had been the required battery capacity. In 2019 the "biobattery" became industrially and economically feasible. The technology was initially developed by Texas University in Austin in 2003; the device produced electric energy owing to the same glucose oxidation reaction that occurs in the human body. | |||

A result in the move towards full electrical cars was a reduced demand for oil. Between 2010 and 2019 the annual oil production increased from 80 billion to 90 billion barrels and the oil price followed the same gradual increase with oil trading at around $120 per barrel. In densely populated areas and developed countries like the US East Coast, Europe and Japan the electrical grid to support electrical cars became fully realized by 2025. The global oil demand was dramatically impacted by this move and with the exception of some 40 million oil fueled cars in Africa, India and South America the predominant use of oil was for plastics, fertilisers and in the pharmaceutical industry. | |||

==New Driving Forces== | |||

*[[Coal Seam Gas]]<br> | |||

*[[Continental Protectionism]]<br> | |||

*[[Drilling Technology]]<br> | |||

*[[Environmental Impact]]<br> | |||

*[[Global Warming]]<br> | |||

*[[Growth of developing markets]] <br> | |||

*[[Increase of International Cooperation in Energy Policy]]<br> | |||

*[[Increasing Efficiency in Energy Use]]<br> | |||

*[[OPEC's Role]]<br> | |||

*[[Open decentralized electricity networks]]<br> | *[[Open decentralized electricity networks]]<br> | ||

*[[ | *[[Proliferation of extremist / dictatorial regimes]]<br> | ||

*[[Remaining Oil Reserves]]<br> | |||

*[[Renewable sources of energy]]<br> | |||

*[[World population growth]] | |||

==Edited Driving Forces== | |||

*[[Energy crisis in Asia]]<br> | |||

*[[Fossil fuel consumption]] <br> | |||

*[[Increasing Mobility]] <br> | |||

*[[Shift to Alternative Energy Sources]] | |||

==Research Questions== | |||

*Will strong political and religious agendas reflect in 'oil politics'? | |||

*Oil, as a strategic asset as well as an energy source. Will there be global political alliances between oil producing and non-producing countries? | |||

*Has OPEC gotten its act together in order to tighten control on oil supplies? | |||

*Will there be strong global government regulations regarding fossil fuel usage? | |||

*How successfull have international agreements (e.g. Kyoto Protocol) been in decreasing energy use? | |||

*How is the world economy developing? | |||

*How is the economy in the emerging markets developing? are they going through the same industrailization process like developed countries? | |||

*Are renewable energy sources economically viable? | |||

*Will consumers demand green energy supply due to ongoing global warming? | |||

*Will the growth of the population continue till 2030? | |||

*Do oil (and gas) continue to be the major source of energy? | |||

*Will the global energy consumption decrease due to improvements in more efficient use of energy? | |||

*What are the chances of finding oil in not yet explored locations such as deep see regions? | |||

*Will improvement in drilling technology increase the oil production? | |||

*What are the alternative energy sources? | |||

*Will changes in mobility change the use of energy? | |||

==Research Topics== | |||

*[[Efficiency in energy usage]] | |||

*[[Energy Demand]] | |||

*[[Geopolitics]] | |||

*[[New Finds]] | |||

*[[Oil Production]] | |||

*[[Oil and Global Warming]] | |||

*[[Peak Oil]] | |||

*[[The Big Crew Change]] | |||

==Systems diagram== | |||

Final systems diagram using Mindmap: [[Media:Oil production system map1.pdf]] | |||

[[Image:Systemsmap 1.JPG|center|First draft systems diagram|frame]] | |||

[[Image:Oil production systems map 2.JPG|center|Second draft systems diagram|frame]] | |||

==Scenario Tree== | |||

[[Image:Oil Production 2030 - Scenario Tree.gif|center|frame|Scenario Tree for Oil Production 2030]] | |||

==Resources== | ==Resources== | ||

| Line 20: | Line 165: | ||

*[http://www.ecb.int/pub/pdf/scpwps/ecbwp855.pdf European Central Bank - Assessing the factors behind oil price changes / Working Paper Series; Jan-2008] | *[http://www.ecb.int/pub/pdf/scpwps/ecbwp855.pdf European Central Bank - Assessing the factors behind oil price changes / Working Paper Series; Jan-2008] | ||

*[http://www.guardian.co.uk/environment/datablog/2009/sep/02/oil-reserves Global oil reserves and fossil fuel consumption] | *[http://www.guardian.co.uk/environment/datablog/2009/sep/02/oil-reserves Global oil reserves and fossil fuel consumption] | ||

*[http://www.iea.org/Textbase/speech/2008/Birol_WEO2008_PressConf.pdf International Energy Agency - Oil Production in 2030 outlook] | |||

*[http://omrpublic.iea.org/ International Energy Agency - Oil Market Report] | *[http://omrpublic.iea.org/ International Energy Agency - Oil Market Report] | ||

*[http://www.ren21.net/pdf/RE_GSR_2009_Update.pdf Renewables Global Status Report 2009 update] | *[http://www.ren21.net/pdf/RE_GSR_2009_Update.pdf Renewables Global Status Report 2009 update] | ||

| Line 28: | Line 174: | ||

*[http://www.simmonsco-intl.com/files/Yale%20Law%20School%20BW.pdf Simmons & Company International - Do Fossil Fuels have a sustainable future?] | *[http://www.simmonsco-intl.com/files/Yale%20Law%20School%20BW.pdf Simmons & Company International - Do Fossil Fuels have a sustainable future?] | ||

*[http://www.simmonsco-intl.com/research.aspx?Type=msspeeches Simmons & Company International - Speeches and papers] | *[http://www.simmonsco-intl.com/research.aspx?Type=msspeeches Simmons & Company International - Speeches and papers] | ||

*[http://ourworld.unu.edu/en/world-energy-outlook-2008 United Nations University - different scenarios and research on global warming and the global energy outlook till 2030] | |||

Latest revision as of 21:34, 26 August 2010

This page contains scenarios about oil production in 2030.

Team Members

- Mihai Andreoiu

- Michael Aouad

- Joost d'Hooghe

- Phil Poetter

- Shirley Yuen

Introduction

During our Scenario Thinking class we explored the future scenarios of "Oil Production in 2030". The main goal was to come up with a set of scenarios that are useful for strategic thinking at oil industry servicing companies.

In our diverse team we had the opportunity to look at the issue from different angles, both with an industry background as well as outsider opinions. We also engaged with industry experts such as commodity traders and energy sector professionals.

The result of our project is a set of 4 scenarios, ranging from a scenario "in line" with the general industry gospel as well as more stretched assumptions such as "N@NO" and "Too little too late".

We have enjoyed exporing the future and hope the scenarios below will help others to prepare for the unknown.

Mihai, Michael, Shirley, Phil, Joost

Scenarios

Following are the 4 scenarios that have been developed for 'Oil Production 2030':

1) Business as usual

The world continued its economic growth into the second and third decade of the 21st century, with the main engines being the emerging markets spearheaded by China and India. The latter in particular experienced leapfrog industrialization.

History is written as “Business as usual” as trends of previous decades consolidated. While the center of economic gravity had been steadily shifting, western countries supported the growth of emerging markets as they were huge consumer markets. Global population growth maintained its leveling-off trend and marginally declined to 1.3% p.a., resulting in 9 billion by 2030. Considering that the lion share of growth took place in emerging markets that had started off from a fractional energy (oil) consumption basis, economic development which stood at the bottom inflection point (see S-shape growth curve) in these countries drove the near exponential consumption growth. The latter only showed signs of reduction in the second half of the third decade.

Energy efficiency made considerable progress in line with joint multi-lateral efforts to support and incentivise research and development in the public and private sector. The G20 were driving most talks and getting all emerging nations on board was one of the primary objectives. Differing national and geographical interests repeatedly represented contentious points and often lead to having a ‘spanner in the works’ when multi-national agreements were sought.

Despite global efforts to replace fossil fuel (oil) consumption the strongly growing private transport sector lead to total demand continuing to outstrip supply. The reason was two-fold: the continued lack of wide-spread secondary infrastructure (e.g. stations where vehicles can be charged with alternatively generated energy); and the additional (switching) cost to the public sector and individuals (ultimately a result of economically viability that varies drastically across the globe). As a result emerging markets became the prime consumers of crude oil.

With the renewed wave of economic growth in emerging countries after 2010 and their subsequent need for oil, substantial power resides with National Oil Companies (NOCs) where reserves are located. Bilateral deals between producing countries (mainly OPEC) and emerging countries become the norm; often associated with oil for technology trades. In addition to economic reasons, oil is traded not only for international currencies but also for show ideological support (as demonstrated in Venezuela where Hugo Chavez rules the "new Cuba").

Overall the 600 billion barrel conventional oil reserve estimated in 2010 declined steadily, while non-conventional oil plays (i.e. tar sands in Canada and "heavy oils" in Venezuela) become more viable as they were exploited more systematically. In 2015 additional reserves were estimated at 3 trillion barrels of (un)conventional oil subsequently revised upward considering further increases in recovery rates (to 45%) due to advances in extraction and production technology. 'Peak oil' has not happened and global daily oil production is up from 80mbpd in 2010 to the 120 mbpd mark in 2030.

With the continued increase in oil demand and diminished conventional oil reserves, as well as higher-cost unconventional oil, crude price rocketed to $300 per barrel in 2020, allowing for more spending towards non-conventional oil R&D and investment into E&P. Despite the often written off "oil industry" and its reputation far below par compared to other sectors that lead to the dooming "crew change" problem, high oil dollars continue to draw (younger) people into the industry – though mainly to producing companies. The latter started to take full charge of their natural deposits and equally localized their talent pool which in turn made them more independent of previously needed western expertise and increased their selling power on global commodity markets.

By 2015 "global warming" became one of the most discussed topics at global forums. To curb emissions underground "cap and store" solutions (carbon sequestration) were considered a reasonable technique to contain CO2. However this was limited to single-source CO2 emitters (power plants). Due to its higher CO2 content, unconventional oil was overweight in power generation. Having been rolled out in most of industrialised and emerging countries by 2020, this technique was planned to be in place until oil can be fully phased out as an economically needed resource.

2) Changing of the Guards

2030: The oil-age is coming to an end - the age of alternative energies is in full swing.

Sequel to previous summits in Rio de Janeiro (1992), Kyoto (1997) and Copenhagen (2009), multi-lateral engagements on the international political scene unfolded and created a momentum that had a lasting impact into the 2nd and third decade of the 21st century. Environmental pressures have been going hand in hand with an increasingly stiffening geopolitical landscape. Discussions on key issues - mainly related to CO2 emission caps by fossil fuels (including oil) and its arguably strong correlation to global warming - have been fierce, but constructive. It became increasingly clear that a strong mandate and commitment were required to move forward. Eventually it took the joint effort of the G20 to threaten the USA (at the time by far the largest CO2 emitter by capita) with an economic export-sanction until the USA ratified the treaty in 2014. This eventually marked the turning point for the non-binding ‘Washington Declaration’ that had been in place until then, as far-reaching regulations with binding agreements had to be put in place within each country to achieve the set goals. Furthermore a plan to assist China and India in implementing CO2 reducing measures and thereby averting the looming super-emitter, was put in place.

All this came at a time when the world had been continuing its economic growth and while population growth (at 0.8% annually) started leveling off by 2015, sooner than anticipated. The world population is just shy of 8 billion in 2030; +17% compared to 2010 levels. Total global energy demand doubled in line with economic development in populous emerging markets.

Increased efforts in research and development led to energy efficiency gains quickly outstripping increases in global energy demand. Strong governmental support has assited the putting in place of the required infrastructure for large-scale alternative energy coverage and required production capacities.

After ‘Peak Oil’ occurred a few years before the turn of the first decade, in 2015, ongoing discussion on reserve figures led to a re-evaluation after which OPEC countries had to adjust their figures significantly downward. From then on oil reserves started depleting at an increasingly fast rate from a maximum of 1.3 trillion barrels to approximately 100 billion barrels in 2030. While non-conventional oil resources are not economically viable to exploit, ongoing production cannot replace dwindling supply. Globally, most wells are in the final stage of their life cycle.

Beyond 2010, but notably after 2015 when the emission treaty took effect, policy changes fundamentally impacted the clean, but even more so, alternative energy landscape. Economic drivers and increasing availability of alternative energy sources in advanced and emerging markets lead to a steady replacement of previously oil-generated energy, leading to a steady decline in oil price. Similarly the much anticipated scarcity of skilled labor in the oil industry failed to appear as decreasing operating activity could be covered by the existing pool of people and productivity gains. Moreover the Middle East and parts of Central / South America as well as the Caspian Region had become the sole centers of oil production as the focus shifted towards easily accessible and cheap oil in politically stable countries. Despite substantial reserves of high-grade crude, West Africa dropped out of the list as continued security concerns represented too much a risk for foreign investors to bear going forward.

3) Too little - Too late

For over 20 years now the world economy has continued to decline; countries have reverted to protectionist practices and limited trading to long term allies at their geographic borders. The international cooperation initiatives such as NATO have lost their meaning and everywhere stronger nationalistic activism is present. There is a strong polarization between West and East, generally split along religious lines. The growth in former emerging markets such as Brazil and India halted as these emerging markets economies were very dependent on international trade which has continued to lag given the more restrictive trade policies of the old economies.

The world population has grown to 9 billion driven especially by poverty in emerging markets, with a potential additional 1 billion people in Asia and Africa.

Global warming reached an all time high, the average global temperature increase of 1.1 degrees from 2010 to 2015, has since doubled. International conferences regarding climate policies have continued to fail to produce agreements and countries have been unwilling to work together to solve climate issues or invest sufficiently in alternative energy. Global warming issues have become increasingly worse and parts of the world population have had to seek refuge in different countries. The climate refugees have caused economic problems which is leading to sustained economic recession and political instability.

In 2030 there are no conventional oil reserves left. In contradiction with earlier estimates Peak Oil happened many years ago. After official corrections of existing reserves and a collapse of OPEC cooperation the estimates continued to be adjusted downwards. In the past years major oil companies and countries were not aware of, or in denial of the peak resulting in an unstable oil supply and a structural shortage of new found exploration sites. Oil production concentrated on conventional sources and little investments were made in exploration efficiency. The oil price decreased to $60 a barrel by 2020 and was still going down due to a second wave of economic recession. The industry crew problem change continued to worsen as oil prices remained low, over the past 20 years people were not interested in joining oil companies, thus the oil industry has continued in a downward cycle.

By 2025 the industry finally acknowledged that Peak Oil had happened and that the conventional oil resources were almost depleted. The price of oil skyrocketted to $300 a barrel. Due to tremendously high prices of oil, oil companies started offering exorbitant bonuses and were able to attract people to work in the oil industry again. However due to the time needed to adequately train staff, and the continued shortage of qualified people, the price of oil moved even higher in the next years. Non-conventional oil exploration intensified in a desperate effort to provide the much needed resource. Although there have been some new finds, due to the slow start, non-conventional oil, alternative energies and more efficient use of energy are not sufficient to replace the conventional oil resources.

In 2030 due to the shortage of energy, transportation has become prohibitive. Trade and business continue to lag. The recession is worsening, creating political instability within countries as the chasm between rich and poor widens. Regional issues between West and East are worsening and terrorist attacks are the order of the day. Economies remain in an extended recession and the world is aware that too little has been done to late.

4) N@NO

It is 2030 and oil production has decreased to 30 billion barrels per year; the oil price loiters around $30 per barrel. Less money is spent in the oil sector as further exploration and technology advancement are no longer required - the conventional reserves appear to be enough to satisfy demand for quite some time. The continuing improvements in "biobattery" technology will allow the move to electrical cars in the sun rich areas that still use petrol engines over the next decade. The oil industry crew change problem has ceased to exist as there is now much less demand for qualified and experienced oil field personnel. The global population is currently around 9 billion.

In 2010 the economy recovered from the economic crisis and energy demand steadily increased. The majority of energy use was for transportation, and specifically for road transportation. Though improved virtual technology provided a realistic alternative for face-to-face contact the distance traveled and number of travelers increased, resulting in an overall increase in demand for road transportation. Due to an increased investment in alternative energies in 2015 a stream of enabling technologies became available, supporting full scale use of electrical cars.

The first key breakthrough was the third generation derivative of the thin-layered paint-able Nano-solar technology. As a result the electricity required to "fuel" the increasing number of electrical cars became available. For many years the main barrier to move from the now common hybrids to full electrical cars had been the required battery capacity. In 2019 the "biobattery" became industrially and economically feasible. The technology was initially developed by Texas University in Austin in 2003; the device produced electric energy owing to the same glucose oxidation reaction that occurs in the human body.

A result in the move towards full electrical cars was a reduced demand for oil. Between 2010 and 2019 the annual oil production increased from 80 billion to 90 billion barrels and the oil price followed the same gradual increase with oil trading at around $120 per barrel. In densely populated areas and developed countries like the US East Coast, Europe and Japan the electrical grid to support electrical cars became fully realized by 2025. The global oil demand was dramatically impacted by this move and with the exception of some 40 million oil fueled cars in Africa, India and South America the predominant use of oil was for plastics, fertilisers and in the pharmaceutical industry.

New Driving Forces

- Coal Seam Gas

- Continental Protectionism

- Drilling Technology

- Environmental Impact

- Global Warming

- Growth of developing markets

- Increase of International Cooperation in Energy Policy

- Increasing Efficiency in Energy Use

- OPEC's Role

- Open decentralized electricity networks

- Proliferation of extremist / dictatorial regimes

- Remaining Oil Reserves

- Renewable sources of energy

- World population growth

Edited Driving Forces

- Energy crisis in Asia

- Fossil fuel consumption

- Increasing Mobility

- Shift to Alternative Energy Sources

Research Questions

- Will strong political and religious agendas reflect in 'oil politics'?

- Oil, as a strategic asset as well as an energy source. Will there be global political alliances between oil producing and non-producing countries?

- Has OPEC gotten its act together in order to tighten control on oil supplies?

- Will there be strong global government regulations regarding fossil fuel usage?

- How successfull have international agreements (e.g. Kyoto Protocol) been in decreasing energy use?

- How is the world economy developing?

- How is the economy in the emerging markets developing? are they going through the same industrailization process like developed countries?

- Are renewable energy sources economically viable?

- Will consumers demand green energy supply due to ongoing global warming?

- Will the growth of the population continue till 2030?

- Do oil (and gas) continue to be the major source of energy?

- Will the global energy consumption decrease due to improvements in more efficient use of energy?

- What are the chances of finding oil in not yet explored locations such as deep see regions?

- Will improvement in drilling technology increase the oil production?

- What are the alternative energy sources?

- Will changes in mobility change the use of energy?

Research Topics

- Efficiency in energy usage

- Energy Demand

- Geopolitics

- New Finds

- Oil Production

- Oil and Global Warming

- Peak Oil

- The Big Crew Change

Systems diagram

Final systems diagram using Mindmap: Media:Oil production system map1.pdf

Scenario Tree

Resources

- BP - Oil reserves / Statistics 2008

- Booz&co - The Upstream Survivors 2009

- European Central Bank - Assessing the factors behind oil price changes / Working Paper Series; Jan-2008

- Global oil reserves and fossil fuel consumption

- International Energy Agency - Oil Production in 2030 outlook

- International Energy Agency - Oil Market Report

- Renewables Global Status Report 2009 update

- Shell Scenarios

- Schlumberger

- Schlumberger - Andrew Gould at Simmons & Company International European Investor Conference

- Schlumberger - Highlighting Heavy Oil

- Simmons & Company International - Do Fossil Fuels have a sustainable future?

- Simmons & Company International - Speeches and papers

- United Nations University - different scenarios and research on global warming and the global energy outlook till 2030