Difference between revisions of "The future of the global economy in 2015"

| Line 194: | Line 194: | ||

[[Image:Scenario_Armageddon_v2.png]] | [[Image:Scenario_Armageddon_v2.png]] | ||

Amsterdam 2020 - In the past 20 years the US public deficit has grown with staggering numbers. The US balance of payments has risen with it to an all time high. The crash of the dollar five years ago has aggravated this effect. Asian governments and investment hedge funds started selling dollars at large amounts, since they lost confidence in the strength of the US economy. Western Europe has followed the Asians, in an attempt to minimize their losses. <br> | Amsterdam 2020 - In the past 20 years the US public deficit has grown with staggering numbers. The US balance of payments has risen with it to an all time high. The crash of the dollar five years ago has aggravated this effect. Asian governments and investment hedge funds started selling dollars at large amounts, since they lost confidence in the strength of the US economy. Western Europe has followed the Asians, in an attempt to minimize their losses. <br><br> | ||

The world is sending 5 billion dollar to the US every day in order to finance the deficits. The Fed had to raise the interest rates (now 7%) every quarter for the past years to keep inflation within proportion. This led to a drop in house prices. In the meanwhile, the average debt of US households has increased. The effect of these trends is that the numbers of bankrupt US citizens has risen. <br> | The world is sending 5 billion dollar to the US every day in order to finance the deficits. The Fed had to raise the interest rates (now 7%) every quarter for the past years to keep inflation within proportion. This led to a drop in house prices. In the meanwhile, the average debt of US households has increased. The effect of these trends is that the numbers of bankrupt US citizens has risen. <br><br> | ||

At the moment several smaller banks have problems with their financial obligations and file for bankruptcy. The central banks of the USA, Europe, China and Japan try to minimize the damage by supporting the smaller banks, but with hardly any result. Stock markets decline as an effect of the decreasing stock prices of these Financials. Following the Financials other companies with big stakes in the US are also getting into trouble. Especially after the announcement of the OPEC a year ago that the decreasing dollar rate has caused them to sell oil barrels from now on in Euros. The insecurity of the financial markets has let to more barter agreements than ever, the increasing access to Internet-2 hosted non-financial markets has provided the ability to do this. | At the moment several smaller banks have problems with their financial obligations and file for bankruptcy. The central banks of the USA, Europe, China and Japan try to minimize the damage by supporting the smaller banks, but with hardly any result. Stock markets decline as an effect of the decreasing stock prices of these Financials. Following the Financials other companies with big stakes in the US are also getting into trouble. Especially after the announcement of the OPEC a year ago that the decreasing dollar rate has caused them to sell oil barrels from now on in Euros. The insecurity of the financial markets has let to more barter agreements than ever, the increasing access to Internet-2 hosted non-financial markets has provided the ability to do this.<br><br> | ||

Four years ago, ExxonMobil, Shell, BP and Texaco opened their books on the search for new oil wells. None of them has been able to meet their targets in the search and exploration of new wells, while the existing wells are depleting. Oil consumption has increased in the past decades, while oil production has stayed at the same level for the past years. A few years ago an American Nobel Price winner predicted that sustainable alternative energy sources will not be cost effective in 2040 at the earliest. These announcements resulted in a steep increase of the oil price. Nowadays, a barrel of crude oil costs €100. This high oil price has affected the supply of food in the world tremendously. The production and transportation has never been so expensive, people are hungry and are starving because they cannot pay for food anymore, even in Western Europe and the US. | Four years ago, ExxonMobil, Shell, BP and Texaco opened their books on the search for new oil wells. None of them has been able to meet their targets in the search and exploration of new wells, while the existing wells are depleting. Oil consumption has increased in the past decades, while oil production has stayed at the same level for the past years. A few years ago an American Nobel Price winner predicted that sustainable alternative energy sources will not be cost effective in 2040 at the earliest. These announcements resulted in a steep increase of the oil price. Nowadays, a barrel of crude oil costs €100. This high oil price has affected the supply of food in the world tremendously. The production and transportation has never been so expensive, people are hungry and are starving because they cannot pay for food anymore, even in Western Europe and the US. <br><br> | ||

The decline in use of oil in the past two years, and the technology of using and producing energy cleaner, does have a positive effect on the quality of the air and environment. The Amazon rain forest is starting to grow again to the surface area level of 2000 via the UN Oil for Forest program. For every barrel of oil that is produced, 10 trees are planted. Global warming has almost come to a halt. | The decline in use of oil in the past two years, and the technology of using and producing energy cleaner, does have a positive effect on the quality of the air and environment. The Amazon rain forest is starting to grow again to the surface area level of 2000 via the UN Oil for Forest program. For every barrel of oil that is produced, 10 trees are planted. Global warming has almost come to a halt.<br><br> | ||

The oil companies now put their cards on the exploration of liquefied natural gas. This type of energy has two advantages: it is abundantly available in Russia and the Middle East. Next to that, it causes less CO2 and NO2 emissions. | The oil companies now put their cards on the exploration of liquefied natural gas. This type of energy has two advantages: it is abundantly available in Russia and the Middle East. Next to that, it causes less CO2 and NO2 emissions. | ||

The combination of the declining dollar and the increasing oil price is tipping the world economy. Large US debt holders turn away from the US when it becomes evident that the US will not be able to pay back their debt. The Chinese and Japanese economies suffer a severe blow, since they are owing a large percentage of the US public debt. Furthermore, their export market is disappearing with the decline of US spending. Still, their economies are growing, but slowly. They suffer from high unemployment rates, because of the high numbers of population in their working ages. | The combination of the declining dollar and the increasing oil price is tipping the world economy. Large US debt holders turn away from the US when it becomes evident that the US will not be able to pay back their debt. The Chinese and Japanese economies suffer a severe blow, since they are owing a large percentage of the US public debt. Furthermore, their export market is disappearing with the decline of US spending. Still, their economies are growing, but slowly. They suffer from high unemployment rates, because of the high numbers of population in their working ages.<br><br> | ||

Western Europe shows a slightly shrinking economy. This is fostered by the ageing population. The decline in the major stock markets and the inability of the governments to change retirement programs led to serious liability problems of pension. In more and more cities retired people are looking for jobs to earn a living. Consumer spending is declining, and most of it goes to basic needs, like food, shelter and healthcare. | Western Europe shows a slightly shrinking economy. This is fostered by the ageing population. The decline in the major stock markets and the inability of the governments to change retirement programs led to serious liability problems of pension. In more and more cities retired people are looking for jobs to earn a living. Consumer spending is declining, and most of it goes to basic needs, like food, shelter and healthcare. <br><br> | ||

The economic downturn in Europe and the USA is an extra burden for the public sector and the social security system. The huge amount of elderly have a great impact on social security spending. Government cannot raise enough taxes to cover public spending. This causes several social problems in Europe and the US: nationalistic and fascistic sentiments rise. | The economic downturn in Europe and the USA is an extra burden for the public sector and the social security system. The huge amount of elderly have a great impact on social security spending. Government cannot raise enough taxes to cover public spending. This causes several social problems in Europe and the US: nationalistic and fascistic sentiments rise.<br><br> | ||

These sentiments have a negative effect on the growing flow of skilled workers from Eastern Europe, Asia and the Middle East that run away from unemployment in their own regions. Problems grow bigger because of this, because the young and skilled workers can pay taxes and can help to stabilize social security. The desperately needed workforce is neglecting the USA and Western Europe and are looking for their fortune in Australia and South America. | These sentiments have a negative effect on the growing flow of skilled workers from Eastern Europe, Asia and the Middle East that run away from unemployment in their own regions. Problems grow bigger because of this, because the young and skilled workers can pay taxes and can help to stabilize social security. The desperately needed workforce is neglecting the USA and Western Europe and are looking for their fortune in Australia and South America.<br><br> | ||

The focus of most EU administrations turn inwards and some anti-EU sentiments gain power. The negotiations with Russian states on their potential EU membership are aborted. France, the Netherlands and Germany abort their membership of the EU, while maintaining the Euro as the their currency. The power block of Europe is gone now, and bargaining power to receive the new energy sources is declining. Asia will be the next power block in the world. | The focus of most EU administrations turn inwards and some anti-EU sentiments gain power. The negotiations with Russian states on their potential EU membership are aborted. France, the Netherlands and Germany abort their membership of the EU, while maintaining the Euro as the their currency. The power block of Europe is gone now, and bargaining power to receive the new energy sources is declining. Asia will be the next power block in the world. | ||

As a consequence of the economic dismay in the world, production and consumption decreases. Less commercial trading and less tourism takes place between Asia, Europe and the USA. The trust between these 3 power blocks after the collective victory over the waves of terrorism in the 2010’s has instantly vanished. Governments are blaming each other for the economic trouble and are focusing on their own needs. | As a consequence of the economic dismay in the world, production and consumption decreases. Less commercial trading and less tourism takes place between Asia, Europe and the USA. The trust between these 3 power blocks after the collective victory over the waves of terrorism in the 2010’s has instantly vanished. Governments are blaming each other for the economic trouble and are focusing on their own needs. <br><br> | ||

The world economy has basically come to a stand-still the past years. Globalisation as a trend has come to a grinding halt. The world has to find a way to let the economy start growing again. | The world economy has basically come to a stand-still the past years. Globalisation as a trend has come to a grinding halt. The world has to find a way to let the economy start growing again. | ||

Revision as of 13:01, 11 December 2005

Introduction

This page will contain the results of the scenario planning process of group 3 of class RSM EMBA05 on the following subject:

The future of the global economy in 2020

The members of Group 3 are:

- Peter Groen

- Wendi Mennen

- Maarten Post

- Harry Schoots

- Eric Verbeek

Research Documentation

http://www.stern.nyu.edu/globalmacro/ which contains a link to an Economist article to get us started: Analysis: The Economist, Sep 06, 2005 The perfect storm.

http://scenariothinking.org/wiki/index.php/The_Future_of_the_Global_Village_in_2020 which contains a scenario of last years students.

http://www.odci.gov/nic/NIC_home.html is the homepage of the National Intelligence Councel. Mapping the Global future is a useful report.

http://www.millenniumassessment.org is the homepage of the Millenium Ecosystem Assessment. Latest research of the MA states that environmental concerns increase opportunities and challenges for business that ultimately might influence the global economy.

http://t21.ca contains a selection of world global trends on different aspects based on many sources. http://t21.ca/economic/index.htm lists the economic key findings.

The Netherlands Bureau for Economic Policy Analysis (CPB) performed a scenario analysis on the economic future of Europe, downloadable from http://www.cpb.nl/eng/econ/lange_termijn/recente_studies.html

Try also this report on Globalisation and the Global Environment: four quantitative scenarios: http://www.cpb.nl/nl/general/org/homepages/aml/gitage_si.pdf

The OECD published a study on the future of the global economy: The Future of Global Economy: Towards a long boom? http://www.oecd.org/dataoecd/42/0/35394025.pdf

The CIA publishes facts of every country and region in the world. http://www.cia.gov/cia/publications/factbook/index.html

International Energy Agency publisehes the World Energy Outlook: http://www.iea.org/Textbase/publications/index.asp

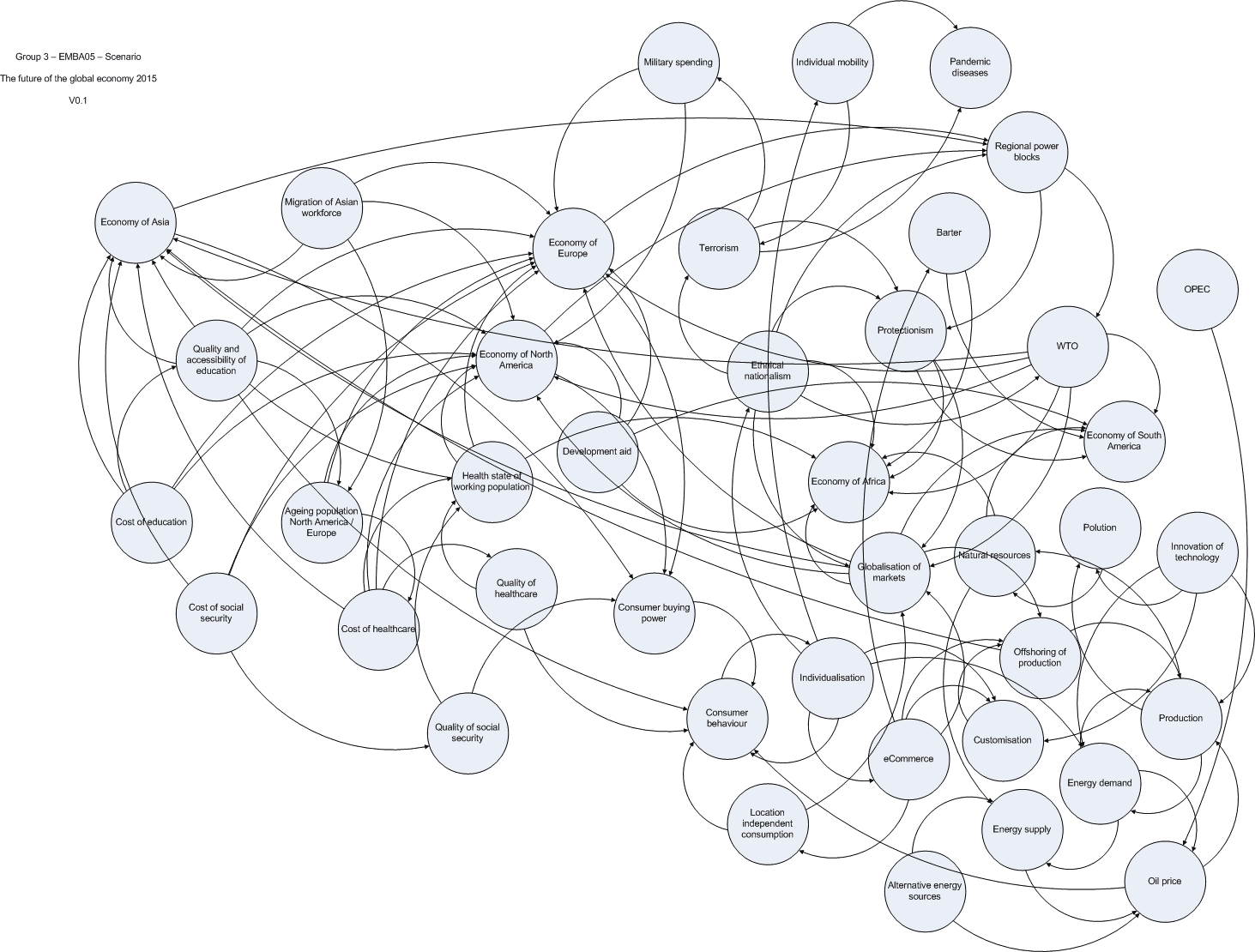

Provisional Systems Diagram (as of Tue Sep 27, 05)[[1]]

Research Questions

Note to group: please add your research questions below.

ECONOMY

Asia

- What is relative GDP to world economy?

- Which countries drive the regional economy?

- What are the trade balances of the major economies in region

- Are the regional economies in terms of GDP increasing, and how rapidly?

Middle East

- What is relative GDP to world economy?

- Which countries drive the regional economy?

- What are the trade balances of the major economies in region

- Are the regional economies in terms of GDP increasing, and how rapidly?

Europe (incl E Eu & Russia)

- What is relative GDP to world economy?

- Which countries drive the regional economy?

- What are the trade balances of the major economies in region

- Are the regional economies in terms of GDP increasing, and how rapidly?

Africa

- What is relative GDP to world economy?

- Which countries drive the regional economy?

- What are the trade balances of the major economies in region

- Are the regional economies in terms of GDP increasing, and how rapidly?

North America

- What is relative GDP to world economy?

- Which countries drive the regional economy?

- What are the trade balances of the major economies in region

- Are the regional economies in terms of GDP increasing, and how rapidly?

South America

- What is relative GDP to world economy?

- Which countries drive the regional economy?

- What are the trade balances of the major economies in region

- Are the regional economies in terms of GDP increasing, and how rapidly?

Global

- What are the trade balances between of the important economies? What is the size and trend in global trade?

- What are the resource constraints with respect to economy? (in terms of natural resources)

- What is the strength of the American Dollar compared to the Euro, Yen, Guan,...? Is it declining of increasing in the past 10 years?

- What other forms of exchange (except) money are used or can be used?

- In the article http://www.ode.nl/article.php?aID=4160 the following exchange forms are mentioned: Communities building Temples in Bali, Elderly Care in Japan, Health insurance companies 'pay' for healthy behahiour, frequent flyer programs and other customer programs.

- On the site http://www.ex.ac.uk/~RDavies/arian/barter.html links are given of all sorts of other forms of trade without using money.

Statistics on barter in 2004: http://www.irta.com/Page.asp?Script=56

Politics

PG:* What will be the role of the Central Banks (ECB, FED)to the economy? (in terms of 'mission statements')

Article on the role of the central banks: http://www.bis.org/publ/cpss55.pdf

Mission of ECB: http://www.ecb.int/pub/pdf/other/ecbhistoryrolefunctions2004en.pdf

Speech Greenspan 25/8/2005: http://www.federalreserve.gov/boarddocs/speeches/2005/20050826/default.htm

PG:* What will be the role of the WTO and UN to the economy? (in terms of 'mission statements')

Role of the UN: http://www.un.org/millennium/sg/report/full.htm

Article on the role of the WTO: http://www.ccc.nps.navy.mil/si/oct03/trade.asp

PG: * What will be the role of the NGOs to the economy?

Article on the future of NGO's: http://www.globalpolicy.org/ngos/role/intro/gen/2000/111400.htm

- What will the effect be of global terrorism on the economy?

The following articles give insight in this topic:

- http://ksghome.harvard.edu/~aabadie/twe.pdf. The main theme of this article is that mobility ofproductive capital in an open economy may account for much of the difference between the direct and the equilibrium impact of terrorism.

- http://www.cia.gov/nic/speeches_terror_and_econ_sec.html Gives an account of the current situation, but also the uncertainties. The speech introduces the NIC 2020 project.

- http://www.odci.gov/nic/NIC_globaltrend2020.html report of the NIC 2020 project with information on terrorism.

- How will the (in)stability of the Middle-Eastern states influence the global economy and the relation of nations?

The following articles give insigth in this subject:

- http://www.cia.gov/nic/confreports_mideast_future.html (Again) from the NIC side. This is an overview of a one-day conference about the middle east for the scenarios of the NIC 2020 project.

- http://www.pbs.org/wgbh/globalconnections/mideast/themes/economics/ gives an overview of economy in the middle east and some usefull links to other sites.

PG:* What will be the effect of the European Union on the global economy (if any)?

Speech Managing Director of the IMF: Towards a stronger Europe in the global economy: http://www.imf.org/external/np/speeches/2003/110303.htm

See the NIC report (top of this page)

PG:* What are the blocks of power and what was the past development?

PG:* What is the global military spending in relation to the global development aid?

- Military expenditures - dollar figure: aggregate real expenditure on arms worldwide in 1999 remained at approximately the 1998 level, about $750 billion (1999) Military expenditures - percent of GDP: roughly 2% of gross world product (1999)(source: http://en.wikipedia.org/wiki/World_economy#Gift_economy)

- Global development aid: Yearly economic aid - recipient: official development assistance (ODA) $50 billion )(source: http://en.wikipedia.org/wiki/World_economy#Gift_economy)

Society

- What are the effects of the ageing population in Europe and North America to the economy?

- How sustainable is the current social security level and health care per region?

Answer to these 2 questions:

- The IMF has published excellent material on how demographic change affect the global economy http://www.imf.org/external/pubs/ft/weo/2004/02/pdf/chapter3.pdf

- What is the effect of increasing education levels on the economy of developing regions?

Environmental

- What are alternative energy sources and what is the speed of development?

From http://en.wikipedia.org/wiki/Renewable_resource (Sep 30,05):Wind power is one of the most cost competitive renewables today. Its long-term technical potential is believed 5 times current global energy consumption or 40 times current electricity demand. This requires 12.7% of all land area, or that land area with Class 3 or greater potential at a height of 80 meters. It assumes that the land is covered with 6 large wind turbines per square kilometer. Offshore resources experience mean wind speeds ~90% greater than that of land, so offshore resources could contribute substantially more energy.[45][46]. This number could also increase with higher altitude ground based or airborne wind turbines

- What are the scarce resources?

From http://en.wikipedia.org/wiki/Future_energy_development (Sep 30, 05) World energy production by source: Oil 40%, natural gas 22.5%, coal 23.3%, hydroelectric 7.0%, nuclear 6.5%, biomass and other 0.7% [5]. In the U.S., transportation accounted for 28% of all energy use and 70% of petroleum use in 2001; 97% of transportation fuel was petroleum

- What is the effect of climate change on the global economy?

- What are the effects of mobility on the environment?

Based on http://www.iea.org/Textbase/publications/index.asp: World Economic Outlook 2000

Technology and business

PG: * How will the development of ICT increase the access possibilities to markets?

See the global Digital Opportunity Initiative:http://www.opt-init.org/framework/pages/contents.html

- What are the effects of off shoring production work by rich countries to low wage countries, and what is the trend?

PG: * What is the growth rate of E-commerce in the world?

- How long does it take the OPEC countries to double their refinery capacity?

The OPEC site http://www.opec.org gives information about OPEC and current prices, supply and demand and considerations. The Annual statistical report.

http://www.nation.com.pk/daily/sep-2005/22/bnews8.php gives a brief overview of current considerations about refining.

http://deseretnews.com/dn/view/0,1249,610152116,00.html gives the plans for expanding refinery capacity.

I still have to call HP for more detailed info!

- What is the effect of the oil prices on the economy?<br>

http://www.globalization101.org/news.asp?NEWS_ID=84 provides a good overview of this subject with useful links.

http://economist.com/printedition/displayStory.cfm?Story_ID=4321834 to show some factors which help to see what the effect is.

http://www.imf.org/external/pubs/ft/weo/2005/01/pdf/chapter1.pdf describes how the oil prices can effect global economy.

I still have to call HP for more detailed info!

- What are the effects of the reducing energy supply on the global economy?

good links on the amount of oil that is there:

From the BBC: http://news.bbc.co.uk/2/hi/business/4681935.stm

From Exxon Mobil where Colin Campbel is refering to in his interview: http://www.feasta.org/documents/wells/contents.html?one/longwell.html

Systems Diagram

Driving Forces

The increasing gap between developed, emerging and poor economies

The increasing effect of the development of technology on the global economy

The effect of Brazil's economy on the global economy

The increasing role of barter in the global economy

The impact of limited availability of natural food resources on the growth of the global economy

Scenario's

Armageddon

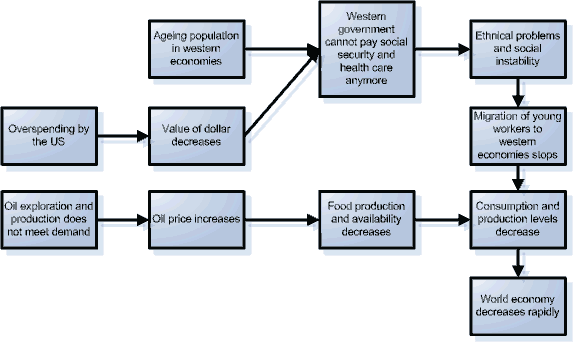

Amsterdam 2020 - In the past 20 years the US public deficit has grown with staggering numbers. The US balance of payments has risen with it to an all time high. The crash of the dollar five years ago has aggravated this effect. Asian governments and investment hedge funds started selling dollars at large amounts, since they lost confidence in the strength of the US economy. Western Europe has followed the Asians, in an attempt to minimize their losses.

The world is sending 5 billion dollar to the US every day in order to finance the deficits. The Fed had to raise the interest rates (now 7%) every quarter for the past years to keep inflation within proportion. This led to a drop in house prices. In the meanwhile, the average debt of US households has increased. The effect of these trends is that the numbers of bankrupt US citizens has risen.

At the moment several smaller banks have problems with their financial obligations and file for bankruptcy. The central banks of the USA, Europe, China and Japan try to minimize the damage by supporting the smaller banks, but with hardly any result. Stock markets decline as an effect of the decreasing stock prices of these Financials. Following the Financials other companies with big stakes in the US are also getting into trouble. Especially after the announcement of the OPEC a year ago that the decreasing dollar rate has caused them to sell oil barrels from now on in Euros. The insecurity of the financial markets has let to more barter agreements than ever, the increasing access to Internet-2 hosted non-financial markets has provided the ability to do this.

Four years ago, ExxonMobil, Shell, BP and Texaco opened their books on the search for new oil wells. None of them has been able to meet their targets in the search and exploration of new wells, while the existing wells are depleting. Oil consumption has increased in the past decades, while oil production has stayed at the same level for the past years. A few years ago an American Nobel Price winner predicted that sustainable alternative energy sources will not be cost effective in 2040 at the earliest. These announcements resulted in a steep increase of the oil price. Nowadays, a barrel of crude oil costs €100. This high oil price has affected the supply of food in the world tremendously. The production and transportation has never been so expensive, people are hungry and are starving because they cannot pay for food anymore, even in Western Europe and the US.

The decline in use of oil in the past two years, and the technology of using and producing energy cleaner, does have a positive effect on the quality of the air and environment. The Amazon rain forest is starting to grow again to the surface area level of 2000 via the UN Oil for Forest program. For every barrel of oil that is produced, 10 trees are planted. Global warming has almost come to a halt.

The oil companies now put their cards on the exploration of liquefied natural gas. This type of energy has two advantages: it is abundantly available in Russia and the Middle East. Next to that, it causes less CO2 and NO2 emissions.

The combination of the declining dollar and the increasing oil price is tipping the world economy. Large US debt holders turn away from the US when it becomes evident that the US will not be able to pay back their debt. The Chinese and Japanese economies suffer a severe blow, since they are owing a large percentage of the US public debt. Furthermore, their export market is disappearing with the decline of US spending. Still, their economies are growing, but slowly. They suffer from high unemployment rates, because of the high numbers of population in their working ages.

Western Europe shows a slightly shrinking economy. This is fostered by the ageing population. The decline in the major stock markets and the inability of the governments to change retirement programs led to serious liability problems of pension. In more and more cities retired people are looking for jobs to earn a living. Consumer spending is declining, and most of it goes to basic needs, like food, shelter and healthcare.

The economic downturn in Europe and the USA is an extra burden for the public sector and the social security system. The huge amount of elderly have a great impact on social security spending. Government cannot raise enough taxes to cover public spending. This causes several social problems in Europe and the US: nationalistic and fascistic sentiments rise.

These sentiments have a negative effect on the growing flow of skilled workers from Eastern Europe, Asia and the Middle East that run away from unemployment in their own regions. Problems grow bigger because of this, because the young and skilled workers can pay taxes and can help to stabilize social security. The desperately needed workforce is neglecting the USA and Western Europe and are looking for their fortune in Australia and South America.

The focus of most EU administrations turn inwards and some anti-EU sentiments gain power. The negotiations with Russian states on their potential EU membership are aborted. France, the Netherlands and Germany abort their membership of the EU, while maintaining the Euro as the their currency. The power block of Europe is gone now, and bargaining power to receive the new energy sources is declining. Asia will be the next power block in the world.

As a consequence of the economic dismay in the world, production and consumption decreases. Less commercial trading and less tourism takes place between Asia, Europe and the USA. The trust between these 3 power blocks after the collective victory over the waves of terrorism in the 2010’s has instantly vanished. Governments are blaming each other for the economic trouble and are focusing on their own needs.

The world economy has basically come to a stand-still the past years. Globalisation as a trend has come to a grinding halt. The world has to find a way to let the economy start growing again.