The Future of Biotechnology for Medical Applications in 2005, Biotech Financial

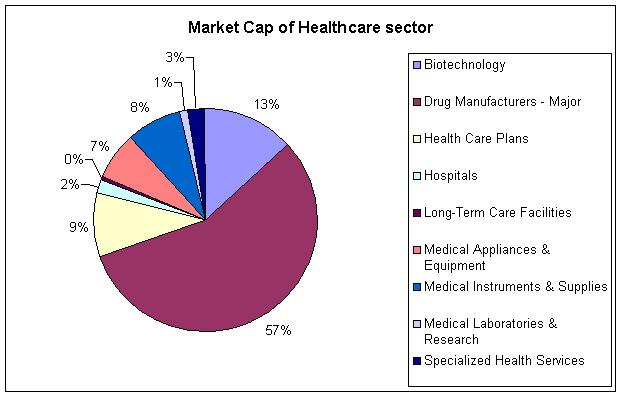

1. What is the market cap of Biotechnology in the healthcare sector

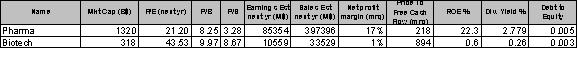

2.What percentage of the turnover of the pharmaceutical industry is generated by

biotech drugs, what percentage is generated by classical drugs?

P/E of biotech sector based on the average of all applicable price earnings reports of biotech companies. Many companies report a N/A price earnings ratio since they have a negative net income.

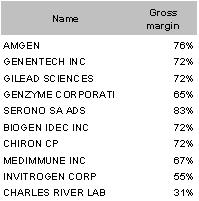

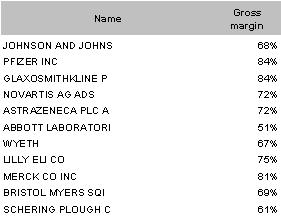

3. Is/Can the cost structure of bio-pharmaceuticals be structurally lower than that of ordinary pharmaceuticals?

The gross margin for biotech companies (ranked by market cap) is shown below

The gross margin for pharma companies (ranked by market cap) is shown below

Conclusion: No visible difference between cost structure of biotech companies as compared to pharma companies

4. How does the financing structure of biotech companies look like and compare with pharma?

Most pharma and bio tech companies are fully equity financed. Have very little debt

5. What is the expected 5 year growth rate of the biotech industry as compared to the pharma industry?

Expected 5 year growth rate of major biotech companies (ranked by market cap) is below

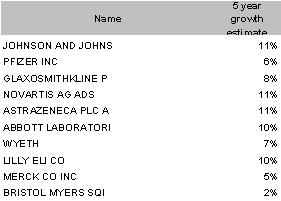

Expected 5 year growth rate of major pharma companies (ranked by market cap) is below

Conclusion: Biotech companies are averaging a growth rate of 20%, while pharma about 8%

Most important financial drivers

1. Expected growth rates (determines investments)

2. Net profit margins

3. Return on equity