Interview with Godfried Bogaerts and Floris Ketel

Introduction

Floris Ketel and Godfried Bogaerts are respectively the Strategic Director and COO of Mirabeau BV. Mirabeau is a Netherlands-based web agency that specializes in designing and building websites for large, mostly for-profit companies such as Vodafone, KLM, ING and AEGON.

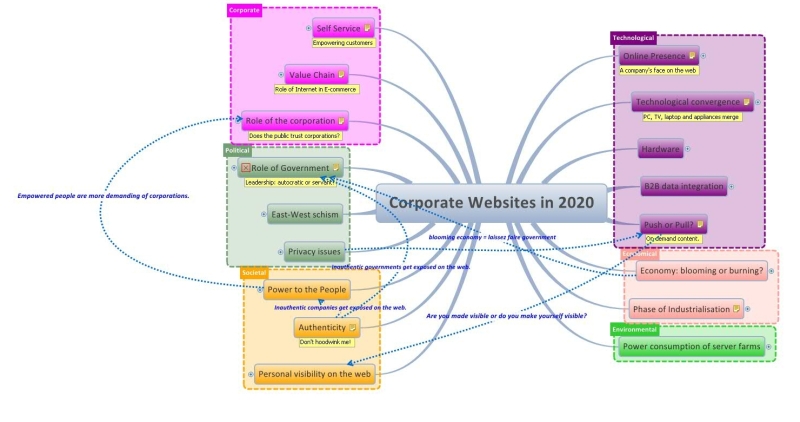

Ketel and Bogaerts were interviewed to get their take on the future of Mirabeau’s business and the direction in which the corporate website is heading. The interview was based on a mindmap (the diagram below gives a condensed version) which was used to trigger conversation about different areas (Political, Economic, Societal, Technological, Environmental and Corporate/Business) of the online landscape.

Specific questions in the interview were around (online) branding and the role of technology for the future of online transactions.

Interview

Conducted on Tuesday 15 September 2009 by Daniel Peters

Brands and the role of Brands

Q: How do you expect brands will develop on the Internet from the perspective of content mashups? With more and more services being bundled and repackaged, it is hard for companies to distinguish themselves if they’re part of that package.

A: Ketel: a central point will always be required. Customers want ease/peace of mind and I strongly believe companies/brands can offer this. That’s what builds affinity with and loyalty for a brand. However, a brand needs a platform to create such affinity and needs to ‘put a face to it’. At the same time, I feel a shift will take place: companies now often seek to control the complete value chain through vertical integration, but as you state their products and services are being used as parts of larger packages, mashed up into new offerings. The shift I see is from companies seeking to integrate vertically and controlling the value chain to those that are able to flexibly combine parts of various value chains into cut-to-size offerings for consumers. If they manage to brand that activity –more than the exact product they deliver– I believe they can compete successfully: offering users what they want, when they want it.

Another take on the company or brand of the future is a social one: a brand will help you through life. The brand (or corporation) could even be seen as a political party or a religion (admittedly, this is taking things far!), with people becoming very attached to companies or brands. The brand always has manifested itself over different channels. The online channel has already become extremely important and will continue to claim an increasingly prominent position. As consumers become more demanding and the Internet achieves ever broader bandwidth, a number of channels/portals for different services could appear. For example, see it this way that the Albert Heijn of the future serves exclusively over the web and delivers to your door. The company can no longer differentiate on price but must do so on product range, speed of delivery and possibly delivers a whole range of other services as well, like integrating laundry services into the package. People start to put a great deal of trust in the company that takes care of all these services, it becomes a ‘partner for life’.

Q: But don’t you think people will want to take control themselves and make there own decisions? Why let some company determine so much for you?

A: Ketel:I do think people will want to take control, “power to the people” as the diagram shows. However, people are becoming increasingly convenience oriented. They want power over stuff that matters, decisions and choices were their opinion is going to make a difference. I think companies need to be aware of this: if you’re delivering a product or service which is highly differentiated, then you won’t be able to steer people in the direction and you have to listen closely, involve them, give them options. But where you’re delivering everyday goods, make the choice for them.

I think the only difference is really the degree to which the consumer is involved in the choice. If as a company you’re aware of the degree of choice your consumer wants (and note: this can be quite different for different consumer bases!) you have the ability to suggest options to exactly the level that consumer expects. In this area, personalized offerings over the web are still a vast territory waiting to be explored. Amazon’s “users who also bought…” is just the beginning.

For (web) interaction designers I feel this is also an important phenomenon. They cannot design for just a single web page or website, but must take the entire customer lifecycle into account. This is a step away from simply positioning one brand on the web towards a more integrative approach, in which the brand plays a role in the daily actions of a consumer.

A: Bogaerts: I have a similar view and tend to see the position of a brand or company as facilitating transactions. I also see brands/companies as placing themselves into consumers’ lives and making actions we take each day easier. There are still vast areas in which innovation is possible from the perspective of making life easier. As I see it, this is a driving force for companies to innovate which is greatly under utilized at present.

Technological/Technology

Q: You take about companies facilitating transactions. Do you also see the infrastructure in this area changing. Are technological drivers working to accelerate this?

A: Bogaerts: Yes and no. On the one hand we see a tendency to facilitate electronic payments as much as possible and I do feel that eventually money will disappear. Companies are already starting to experiment with this, e.g. the "Linden Dollars" used in Second Life and the fact that in Africa you can use mobile phone credits to pay with and active trade takes place using this currency.

However, I do see that, especially in developed countries this is a pretty slow movement. This is in part due to our banking system -banks have invested billions in putting secure and robust electronic payment systems in place, they need to earn those investments back but also due to the fact that our payment systems are adequate. Nevertheless, as I said above, companies capitalizing on consumer demand for ease of use usually prevail eventually and I expect that based on that, we will see mobile credits and forms of online currencies taking off quite soon now.

Q: Don’t you see a security issue here though? As you say, banks have invested in systems which are secure and people trust. Will they adopt a new payment system if it isn’t approved by a bank?

A: Bogaerts:That's a good question. Security is a hot issue at the moment and I think we really need a breakthrough here. Only once my only identity can be established with 100% certainty, can I transact securely online. The more I do on the web and the more the real and virtual world become intertwined, the more essential it becomes that my identity can be tied to me. We've heard about cases of "identity theft" over the past years and these scare consumers away from transacting online. As far as I see it security online should become a commodity, just like having access to a high-speed Internet connection has become for most citizens in The Netherlands.

A: Ketel: (filling in)Technology is starting to offer sophisticated solutions here though, but these are still quite 'scary' for most people, as they're usually tied to biometrics: fingerprints, iris scans and prototypes of real-time DNA readers are already available. Tying these to peoples' devices to access the web means that people can quite confidently go online.