Difference between revisions of "Growth of developing markets"

| (10 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

==Description:== | ==Description:== | ||

By Syuen | |||

Developing markets are increasingly growing and it can be expected that the centre of global economic gravity will change from the developed to the developing markets. The average growth rate of the developed markets is between 0.1-0.2 percentage points per annum for the period to 2050. For developing countries the growth rate is on average more than 3-4% per annum. While the developing markets are growing, they will go through this industrialization phase in which their economy will be predicted to be more energy intensive than the increasingly service-driven economies of the developed markets. Due to strong economic growth, China an dIndia account for half of the increase in world primary energy demand between 2006-2030. | |||

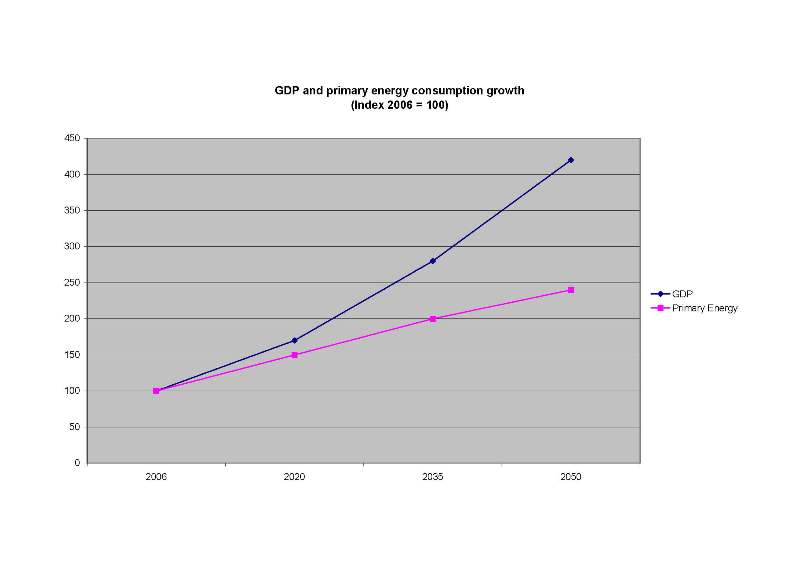

Based on growth of developing markets, PWC has developed a scenario of growth based on the developed and developing markets and created the Business as usual scenario linking GDP growth to energy consumption. See below a growth that Gap growth is 3.4% per annum, in this way primary energy consumption is growing with 2% per annum. | |||

[[Image:New GDP and primary energy consumption growth.jpg]] | [[Image:New GDP and primary energy consumption growth.jpg]] | ||

| Line 13: | Line 17: | ||

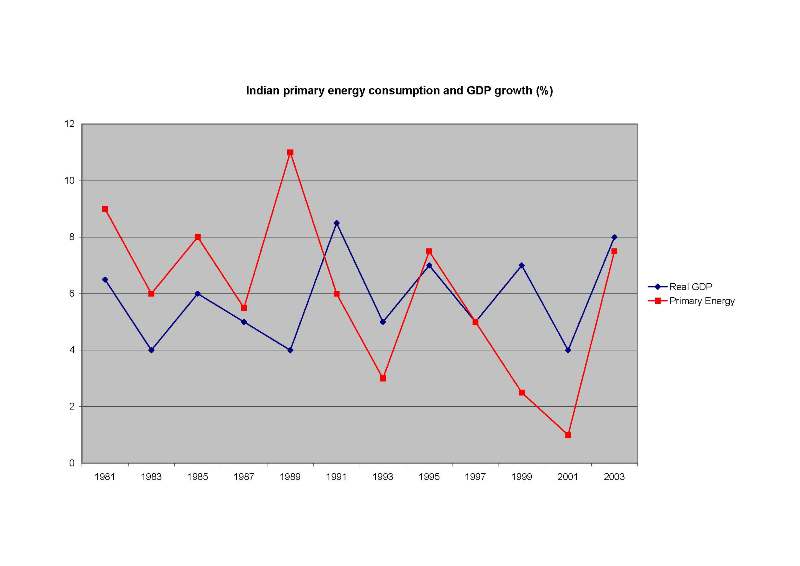

For the developing markets, for example India, it can be seen that primary energy consumption is highly linked to real GDP growth. For the period from 1981 to 2003, the primary energy consumption has averaged only 0.2% per annum less than real GDP growth. | |||

[[Image:New Indian primary energy consumption and GDP growth.jpg]] | [[Image:New Indian primary energy consumption and GDP growth.jpg]] | ||

| Line 23: | Line 28: | ||

1. Growth in physical capital stock (new capital investment less depreciation of | 1. Growth in physical capital stock (new capital investment less depreciation of | ||

the existing capital stock) | the existing capital stock) | ||

2. Growth in the labour force | 2. Growth in the labour force | ||

3. Growth in the quality of labour (education levels of the workforce) | 3. Growth in the quality of labour (education levels of the workforce) | ||

4. Technological progress | 4. Technological progress | ||

==Inhibitors:== | ==Inhibitors:== | ||

1. Working age population going up | |||

2. Education level remains underdeveloped | |||

3. Institutional frameworks which are not efficient (no democratic system) | |||

==Paradigms:== | ==Paradigms:== | ||

1. The growth of the developing markets are driving the growth of the world economy | |||

2. The growth of the developing market will cause a higher demand in energy sources as the developed markets will go into a stage of industralization which creaters a higher demand in energy | |||

3. The two main developing markets: China and India are currently using coal, but with the economic growth, it can be expected that they will increasingly use more oil | |||

==Timing:== | ==Timing:== | ||

| Line 44: | Line 59: | ||

2. http://www.pwc.com/en_GX/gx/world-2050/pdf/world_in_2050_carbon_emissions_08_2.pdf | 2. http://www.pwc.com/en_GX/gx/world-2050/pdf/world_in_2050_carbon_emissions_08_2.pdf | ||

3. http://www.pwc.com/en_GX/gx/world-2050/pdf/world2050carbon.pdf | |||

Latest revision as of 18:12, 17 September 2009

Description:

By Syuen

Developing markets are increasingly growing and it can be expected that the centre of global economic gravity will change from the developed to the developing markets. The average growth rate of the developed markets is between 0.1-0.2 percentage points per annum for the period to 2050. For developing countries the growth rate is on average more than 3-4% per annum. While the developing markets are growing, they will go through this industrialization phase in which their economy will be predicted to be more energy intensive than the increasingly service-driven economies of the developed markets. Due to strong economic growth, China an dIndia account for half of the increase in world primary energy demand between 2006-2030.

Based on growth of developing markets, PWC has developed a scenario of growth based on the developed and developing markets and created the Business as usual scenario linking GDP growth to energy consumption. See below a growth that Gap growth is 3.4% per annum, in this way primary energy consumption is growing with 2% per annum.

Source: PWC calculation using IMF, GDP data and BP data on primary energy consumption

For the developing markets, for example India, it can be seen that primary energy consumption is highly linked to real GDP growth. For the period from 1981 to 2003, the primary energy consumption has averaged only 0.2% per annum less than real GDP growth.

Source: PWC, Worldbank and BP

Enablers:

1. Growth in physical capital stock (new capital investment less depreciation of the existing capital stock)

2. Growth in the labour force

3. Growth in the quality of labour (education levels of the workforce)

4. Technological progress

Inhibitors:

1. Working age population going up

2. Education level remains underdeveloped

3. Institutional frameworks which are not efficient (no democratic system)

Paradigms:

1. The growth of the developing markets are driving the growth of the world economy

2. The growth of the developing market will cause a higher demand in energy sources as the developed markets will go into a stage of industralization which creaters a higher demand in energy

3. The two main developing markets: China and India are currently using coal, but with the economic growth, it can be expected that they will increasingly use more oil

Timing:

Web Resources:

1. http://www.pwc.com/en_GX/gx/world-2050/pdf/world_2050_brics.pdf

2. http://www.pwc.com/en_GX/gx/world-2050/pdf/world_in_2050_carbon_emissions_08_2.pdf

3. http://www.pwc.com/en_GX/gx/world-2050/pdf/world2050carbon.pdf