Difference between revisions of "Oil price"

(→Enablers:: gave up) |

(1003) |

||

| (37 intermediate revisions by one other user not shown) | |||

| Line 1: | Line 1: | ||

= | 92PSTZ <a href="http://vqjvdeeleqqb.com/">vqjvdeeleqqb</a>, [url=http://fyvqvkymhidh.com/]fyvqvkymhidh[/url], [link=http://lnaubvalyerc.com/]lnaubvalyerc[/link], http://gdashxjqyuzo.com/ | ||

[ | |||

==Enablers:== | ==Enablers:== | ||

*Global economic growth spurs demand. Huge increase of oil consumption in Brics (Brazil, Russia, India, China) | *[[Global economic growth]] spurs oil demand. | ||

*[[Demand for Oil]] - Increasing | |||

*Huge increase of oil consumption in Brics (Brazil, Russia, India, China) | |||

*[[Oil dependence]] - heavy. | |||

*[[Elasticity of Oil supply]] - very inelastic. Higher prices do not significantly increase oil production. | |||

*[[Elasticity of Oil demand]] - very inelastic. Higher prices do not significantly deter oil consumption. | |||

*[[Oil production]] - near peak. Spare production capacity acts as a cushion in the oil supply chain. A lower spare capacity diminishes the ability to absorb supply-demand shocks, leading to higher price. | |||

*[[Oil refining capacity]] - near peak capacity. | |||

*[[Oil shipping capacity]] - near peak capacity. | |||

*[[Oil inventories]] low. | |||

*Not enough [[Oil contracts|oil contracts]] available for purchase | |||

*Failure of international agreement to reduce oil consumption | |||

*Oil spills [http://www.epa.gov/oilspill/] | |||

*Intangibles - Politics in Middle east, Economic Uncertainty | |||

* | ==Inhibitors:== | ||

*[[Global depression]] | |||

*Decrease in [[oil dependence]] | |||

*Development of a new or alternate source of energy | |||

*Lower [[oil demand ]] from lower energy consumption lifestyle changes | |||

*Reduction of [[oil consumption]] through environmental awareness | |||

* | *Increase in [[oil supply]] | ||

*Massive new [[oil discoveries]] leading to more oil production | |||

*A surplus of [[oil contracts]] available for purchase | |||

*Increase in [[oil shipping capacity]] | |||

* | *[[Energy consumption regulation]] | ||

*[[Carbon tax]] | |||

*International agreements to reduce [[oil consumption]] | |||

*[[CAFE standards]] | |||

* | *Increase in efficiencies | ||

* | *Intangibles - Peace in Middle east, Economic stability | ||

* | ==Paradigms:== | ||

*Supply and demand | |||

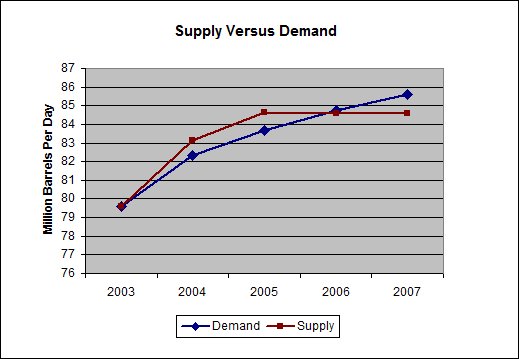

It is thought by some that we are in [http://en.wikipedia.org/wiki/Peak_oil Peak oil] since 2006. Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline.[http://en.wikipedia.org/wiki/Peak_oil] | |||

[[Image:World-oil-supply-demand.jpg]] | |||

Peak oil is not about running out of oil, it's about the rate at which oil can be supplied to the market. If the rate at which it is demanded exceeds the rate at which it can be supplied, oil prices will go up. | |||

*Inflation / [[Declining Dollar]] | |||

In an attempt to stimulate the ailing U.S. economy, the the Federal Reserve has cut rates by three percentage points since September 2007. But the rate cuts are also inflationary, weakening the dollar and sending oil prices higher.[http://money.cnn.com/2008/04/29/news/economy/oil_dollar/] | |||

Since the oil price is indexed to the dollar, as the dollar drops in value, the price of oil increases.[http://www.iht.com/articles/2008/07/08/business/09oil.php] If one looks at inflation adjusted oil prices, they remain relatively flat.[http://www.econbrowser.com/archives/2006/10/is_peak_oil_irr.html] | |||

*Speculation | |||

As the dollar continues to depreciate in value, investors have bought oil futures as a hedge against inflation.[http://money.cnn.com/2008/04/29/news/economy/oil_dollar/] It is thought that as much as 60% of today's crude oil price is pure speculation driven by large trader banks and hedge funds.[http://www.atimes.com/atimes/Global_Economy/JE06Dj07.html][http://money.cnn.com/magazines/fortune/fortune_archive/2006/05/29/8378002/index.htm] | |||

*War | |||

Oil prices are high because the United States is actively engaged in wars in Iraq and Afghanistan and perusing war with Iran in the middle east.[http://www.nakedcapitalism.com/2008/06/did-iraq-war-cause-high-oil-prices.html] | |||

*Resource Nationalism | |||

"Resource nationalism" and political tensions in Nigeria, Venezuela, Iran and even Mexico are further constraining supply.[http://www.aviationweek.com/aw/generic/story_channel.jsp?channel=comm&id=news/SPEC07118.xml] These oil producing countries would like to use the oil in their countries to develop the country rather than to make the oil available to world markets. | |||

*Monopoly | |||

OPEC - the oil cartel may still have influence over oil prices by controlling how much oil is produced | |||

==Experts:== | ==Experts:== | ||

*M. King Hubbert | *[http://en.wikipedia.org/wiki/M._King_Hubbert M. King Hubbert] | ||

*Kenneth S. Deffeyes | *[http://en.wikipedia.org/wiki/Kenneth_S._Deffeyes Kenneth S. Deffeyes ] | ||

*T. Boone Pickens | *[http://en.wikipedia.org/wiki/T._Boone_Pickens T. Boone Pickens] | ||

*Colin Campbell | *[http://en.wikipedia.org/wiki/Colin_Campbell_%28geologist%29 Colin Campbell] | ||

*[http://de.wikipedia.org/wiki/Claudia_Kemfert Claudia Kemfert] | |||

==Timing:== | ==Timing:== | ||

| Line 79: | Line 82: | ||

*[http://www.eia.doe.gov/ DOE: Energy Information Administration (EIA)] | *[http://www.eia.doe.gov/ DOE: Energy Information Administration (EIA)] | ||

*[http://www. | *[http://www.peakoil.net/ The Association for the Study of Peak Oil and Gas (ASPO)] | ||

Latest revision as of 15:46, 4 February 2010

92PSTZ <a href="http://vqjvdeeleqqb.com/">vqjvdeeleqqb</a>, [url=http://fyvqvkymhidh.com/]fyvqvkymhidh[/url], [link=http://lnaubvalyerc.com/]lnaubvalyerc[/link], http://gdashxjqyuzo.com/

Enablers:

- Global economic growth spurs oil demand.

- Demand for Oil - Increasing

- Huge increase of oil consumption in Brics (Brazil, Russia, India, China)

- Oil dependence - heavy.

- Elasticity of Oil supply - very inelastic. Higher prices do not significantly increase oil production.

- Elasticity of Oil demand - very inelastic. Higher prices do not significantly deter oil consumption.

- Oil production - near peak. Spare production capacity acts as a cushion in the oil supply chain. A lower spare capacity diminishes the ability to absorb supply-demand shocks, leading to higher price.

- Oil refining capacity - near peak capacity.

- Oil shipping capacity - near peak capacity.

- Oil inventories low.

- Not enough oil contracts available for purchase

- Failure of international agreement to reduce oil consumption

- Oil spills [1]

- Intangibles - Politics in Middle east, Economic Uncertainty

Inhibitors:

- Global depression

- Decrease in oil dependence

- Development of a new or alternate source of energy

- Lower oil demand from lower energy consumption lifestyle changes

- Reduction of oil consumption through environmental awareness

- Increase in oil supply

- Massive new oil discoveries leading to more oil production

- A surplus of oil contracts available for purchase

- Increase in oil shipping capacity

- Energy consumption regulation

- Carbon tax

- International agreements to reduce oil consumption

- CAFE standards

- Increase in efficiencies

- Intangibles - Peace in Middle east, Economic stability

Paradigms:

- Supply and demand

It is thought by some that we are in Peak oil since 2006. Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline.[2]

Peak oil is not about running out of oil, it's about the rate at which oil can be supplied to the market. If the rate at which it is demanded exceeds the rate at which it can be supplied, oil prices will go up.

- Inflation / Declining Dollar

In an attempt to stimulate the ailing U.S. economy, the the Federal Reserve has cut rates by three percentage points since September 2007. But the rate cuts are also inflationary, weakening the dollar and sending oil prices higher.[3]

Since the oil price is indexed to the dollar, as the dollar drops in value, the price of oil increases.[4] If one looks at inflation adjusted oil prices, they remain relatively flat.[5]

- Speculation

As the dollar continues to depreciate in value, investors have bought oil futures as a hedge against inflation.[6] It is thought that as much as 60% of today's crude oil price is pure speculation driven by large trader banks and hedge funds.[7][8]

- War

Oil prices are high because the United States is actively engaged in wars in Iraq and Afghanistan and perusing war with Iran in the middle east.[9]

- Resource Nationalism

"Resource nationalism" and political tensions in Nigeria, Venezuela, Iran and even Mexico are further constraining supply.[10] These oil producing countries would like to use the oil in their countries to develop the country rather than to make the oil available to world markets.

- Monopoly

OPEC - the oil cartel may still have influence over oil prices by controlling how much oil is produced

Experts:

Timing:

- 1965, Oil discovery rate peaked

- 1973, Oil shock. The fourth Middle-East Wars acted as trigger.

- 1991, Gulf war.

- 2003, Iraq war.

- 2007, Peak oil. World oil production peaked.

- 2008, The oil price has been steadily increasing and hits a record high at $147.27/barrel.