Difference between revisions of "Economical factors"

m |

|||

| (9 intermediate revisions by the same user not shown) | |||

| Line 2: | Line 2: | ||

1. What percentage of consumers would subscribe to location-based services, and how much are they willing to pay?<br> | 1. <b><i>What percentage of consumers would subscribe to location-based services, and how much are they willing to pay, and what are there interests?</i></b> | ||

<br> | |||

<br> | <br> | ||

While the market for LBS has been slow to take off, consumers continue to confirm their interest in these services. Many who have used the services find them indispensable. Industry's challenge is to provide consumers with simple and affordable services they can access without a major investment in equipment or services they may not need. Consumers want to pick the services they want and the type of device most suitable for their lyfestyle.[1]<br><br> | While the market for LBS has been slow to take off, consumers continue to confirm their interest in these services. Many who have used the services find them indispensable. Industry's challenge is to provide consumers with simple and affordable services they can access without a major investment in equipment or services they may not need. Consumers want to pick the services they want and the type of device most suitable for their lyfestyle.[1]<br><br> | ||

In August 1999, Driscoll-Wolfe Marketing & Research Consulting completed a multiclient marketing research study designed to answer questions about consumer interest and willingness to pay for location-based services. This study was funded partially by major cellular carriers, telematics equipment and services suppliers, software developers for wireless platforms, and other technology companies.<br><br> | "In August 1999, Driscoll-Wolfe Marketing & Research Consulting completed a multiclient marketing research study designed to answer questions about consumer interest and willingness to pay for location-based services. This study was funded partially by major cellular carriers, telematics equipment and services suppliers, software developers for wireless platforms, and other technology companies. The research findings showed a substantially greater interest in location-based services among consumers who currently subscribe to cellular service than among nonsubscribers.<br><br> | ||

A critical issue covered in the study was consumer willingness to pay for location-based services. In the nationwide survey, respondents who were cellular subscribers were asked if they would pay a monthly fee for each of 10 location-based services. Half of the sample indicated a willingness to pay $5 per month for one or more of the services. These findings indicate that while interest in the services declines when consumers are told they must pay a fee for the service, many cellular subscribers would be willing to pay a "reasonable" monthly fee, in addition to their current cellular bill, for access to location-based services. The data also shows consumers are interested in bundled services offered at a reasonable monthly rate.<br><br> | |||

The research study also assessed whether consumers would prefer to pay for convenience services on a monthly or per-transaction basis. Most focus group participants would prefer to pay on a per-transaction basis for services such as routing assistance, mobile Yellow Pages, traffic alerts and information services. The survey confirmed consumers would pay a "reasonable" per-transaction fee for these services." [2]<br> | |||

<br> | |||

2. <b><i>Who bears the operating costs of the common infrastructure?</i></b> <br><br> | |||

There are two clear operator trends today in Europe that are very positive for LBS:[3] | |||

<ul><li> | |||

Growing competition among the operators on more mature markets.</li> | |||

<li>Emergency call within EU. There are still possibilities for mandates pushing the operators to invest in location-based services.</li></ul> | |||

This trends show us that the operators are a big part in paying the expenses for keeping this infrastructure up and running. The next quote shows us the role of the European Union in subsidizing LBS operating costs: <br> | |||

"The European Union plans to subsidize about one-third of the operating costs of a satellite system that European Aeronautic Defense & Space, Alcatel and Eutelsat are completing to start up and run with partners.<br> | |||

The European Commission earmarked an average of €71 million, or $87 million, a year for the Galileo road, rail, ship and air-traffic control network in its budget for 2007-2013. The 30-satellite network, planned to vie with the U.S. global positioning system as of 2008, is projected to cost €220 million a year to operate.<br> | |||

"We want industry to meet most of the operating costs because this is the commercial phase when companies earn money from services," said Amador Sanchez Rico, a spokesman of the commission. The EU's national governments must approve the spending plans."[4]<br><br> | |||

3. <b><i>How dependent are location based service providers on the owners of the infrastructure and other service providers in terms of pricing?</i></b><br> | |||

Network operators will charge each other for the use of location resource to support the service. In addition, the serving network operator is entitled to charge the home operator for the use of the service by the visiting user. The charging principles for Location Based Services are up to the network operator. The charge for this service will be transferred using the TAP inter-operator charging procedure. The Transferred Account Procedure is the mechanism by which operators exchange roaming billing information. This is how roaming partners are able to bill each other for the use of networks and services through a standard process.[5]<br> | |||

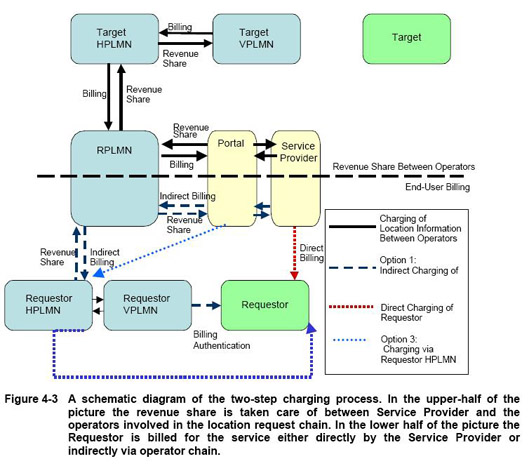

In telecommunication, a public land mobile network (PLMN) is a network that is established and operated by an administration or by a recognized operating agency (ROA) for the specific purpose of providing land mobile telecommunications services to the public. <br> | |||

VPLMN = Visiting PLMN<br> | |||

RPLMN = Requesting PLMN<br> | |||

HPLMN = Home PLMN<br> | |||

See the figure below, for a flow of revenues involving all entities.[5]<br> | |||

[[Image:LBS_charging.jpg]] | |||

4. <b><i>How stable is the underlying infrastructure? Does this stability change with expansion?</i></b><br> | |||

"By following revised procedures in disposing of decommissioned GPS satellites the possibility of collisions between these and operating satellites can be greatly reduced, researchers at The Aerospace Corporation have concluded. | |||

In studies for the Air Force, researcher Dr. Chia-Chun (George) Chao discovered that GPS satellites placed in disposal orbits can eventually, perhaps in 20 to 40 years, encroach into the operating constellation. | |||

This is because the disposal orbits, while circular initially, become increasingly elliptical, mostly as the result of sun-moon gravitational perturbations. | |||

Besides intersecting the GPS constellation, these satellites eventually could pose a threat to operational satellites in low Earth and geosynchronous orbits, Dr. Chao said. | |||

The GPS constellation, comprising 28 satellites, operates at medium Earth orbit, about 11,000 nautical miles above Earth. | |||

The solution, Aerospace studies show, is to | |||

<ul> | |||

<li>ensure that used satellites are inserted into disposal orbits at least 500 kilometers (310 miles) higher than the altitude of the GPS constellation</li> | |||

<li>reduce the initial eccentricity of the disposal orbit through precise satellite burn maneuvers</li> | |||

<li>reduce the growth of orbit eccentricity by circularizing the initial disposal orbit as much as possible and by achieving a more favorable "argument of perigee," or orientation of the perigee relative to the equatorial plane</li> | |||

</ul>" [7] | |||

References:<br> | References:<br> | ||

[1] Driscoll, Clement (july 2002). What do consumers really think? (About Location-Based Services). GPS World, pg.34-37.<br> | [1] Driscoll, Clement (july 2002). What do consumers really think? (About Location-Based Services). GPS World, pg.34-37.<br> | ||

[2] Driscoll, Clement. Study gauges consumer interest in location-based services. RCR; 02/28/2000, Vol. 19 Issue 9, p68, | [2] Driscoll, Clement. Study gauges consumer interest in location-based services. RCR; 02/28/2000, Vol. 19 Issue 9, p68<br> | ||

[3] [http://www.researchandmarkets.com/reportinfo.asp?report_id=304431&t=e&cat_id=20 www.researchandmarkets.com]<br> | |||

[4] [http://www.galileo-industries.net/galileo/galileo.nsf/pages/48C1323EA745725CC1256FA8003CD750?OpenDocument&e www.galileo-industries.net]<br> | |||

[5] [http://www.gsmworld.com/using/billing/potential.shtml GSMWorld TAP]<br> | |||

[6] Engblom, Katherina (january 2003). Location Based Services v3.10 GSM World, the wireless evolution, Permanent Reference Document SE23<br> | |||

[7] [http://www.aero.org/news/newsitems/procedures-030702.html New Procedures Can Prevent Used GPS Satellites from Intersecting with Constellation]<br> | |||

Latest revision as of 16:03, 27 March 2006

Research questions Economical factors

1. What percentage of consumers would subscribe to location-based services, and how much are they willing to pay, and what are there interests?

While the market for LBS has been slow to take off, consumers continue to confirm their interest in these services. Many who have used the services find them indispensable. Industry's challenge is to provide consumers with simple and affordable services they can access without a major investment in equipment or services they may not need. Consumers want to pick the services they want and the type of device most suitable for their lyfestyle.[1]

"In August 1999, Driscoll-Wolfe Marketing & Research Consulting completed a multiclient marketing research study designed to answer questions about consumer interest and willingness to pay for location-based services. This study was funded partially by major cellular carriers, telematics equipment and services suppliers, software developers for wireless platforms, and other technology companies. The research findings showed a substantially greater interest in location-based services among consumers who currently subscribe to cellular service than among nonsubscribers.

A critical issue covered in the study was consumer willingness to pay for location-based services. In the nationwide survey, respondents who were cellular subscribers were asked if they would pay a monthly fee for each of 10 location-based services. Half of the sample indicated a willingness to pay $5 per month for one or more of the services. These findings indicate that while interest in the services declines when consumers are told they must pay a fee for the service, many cellular subscribers would be willing to pay a "reasonable" monthly fee, in addition to their current cellular bill, for access to location-based services. The data also shows consumers are interested in bundled services offered at a reasonable monthly rate.

The research study also assessed whether consumers would prefer to pay for convenience services on a monthly or per-transaction basis. Most focus group participants would prefer to pay on a per-transaction basis for services such as routing assistance, mobile Yellow Pages, traffic alerts and information services. The survey confirmed consumers would pay a "reasonable" per-transaction fee for these services." [2]

2. Who bears the operating costs of the common infrastructure?

There are two clear operator trends today in Europe that are very positive for LBS:[3]

- Growing competition among the operators on more mature markets.

- Emergency call within EU. There are still possibilities for mandates pushing the operators to invest in location-based services.

This trends show us that the operators are a big part in paying the expenses for keeping this infrastructure up and running. The next quote shows us the role of the European Union in subsidizing LBS operating costs:

"The European Union plans to subsidize about one-third of the operating costs of a satellite system that European Aeronautic Defense & Space, Alcatel and Eutelsat are completing to start up and run with partners.

The European Commission earmarked an average of €71 million, or $87 million, a year for the Galileo road, rail, ship and air-traffic control network in its budget for 2007-2013. The 30-satellite network, planned to vie with the U.S. global positioning system as of 2008, is projected to cost €220 million a year to operate.

"We want industry to meet most of the operating costs because this is the commercial phase when companies earn money from services," said Amador Sanchez Rico, a spokesman of the commission. The EU's national governments must approve the spending plans."[4]

3. How dependent are location based service providers on the owners of the infrastructure and other service providers in terms of pricing?

Network operators will charge each other for the use of location resource to support the service. In addition, the serving network operator is entitled to charge the home operator for the use of the service by the visiting user. The charging principles for Location Based Services are up to the network operator. The charge for this service will be transferred using the TAP inter-operator charging procedure. The Transferred Account Procedure is the mechanism by which operators exchange roaming billing information. This is how roaming partners are able to bill each other for the use of networks and services through a standard process.[5]

In telecommunication, a public land mobile network (PLMN) is a network that is established and operated by an administration or by a recognized operating agency (ROA) for the specific purpose of providing land mobile telecommunications services to the public.

VPLMN = Visiting PLMN

RPLMN = Requesting PLMN

HPLMN = Home PLMN

See the figure below, for a flow of revenues involving all entities.[5]

4. How stable is the underlying infrastructure? Does this stability change with expansion?

"By following revised procedures in disposing of decommissioned GPS satellites the possibility of collisions between these and operating satellites can be greatly reduced, researchers at The Aerospace Corporation have concluded.

In studies for the Air Force, researcher Dr. Chia-Chun (George) Chao discovered that GPS satellites placed in disposal orbits can eventually, perhaps in 20 to 40 years, encroach into the operating constellation.

This is because the disposal orbits, while circular initially, become increasingly elliptical, mostly as the result of sun-moon gravitational perturbations.

Besides intersecting the GPS constellation, these satellites eventually could pose a threat to operational satellites in low Earth and geosynchronous orbits, Dr. Chao said.

The GPS constellation, comprising 28 satellites, operates at medium Earth orbit, about 11,000 nautical miles above Earth.

The solution, Aerospace studies show, is to

- ensure that used satellites are inserted into disposal orbits at least 500 kilometers (310 miles) higher than the altitude of the GPS constellation

- reduce the initial eccentricity of the disposal orbit through precise satellite burn maneuvers

- reduce the growth of orbit eccentricity by circularizing the initial disposal orbit as much as possible and by achieving a more favorable "argument of perigee," or orientation of the perigee relative to the equatorial plane

" [7]

References:

[1] Driscoll, Clement (july 2002). What do consumers really think? (About Location-Based Services). GPS World, pg.34-37.

[2] Driscoll, Clement. Study gauges consumer interest in location-based services. RCR; 02/28/2000, Vol. 19 Issue 9, p68

[3] www.researchandmarkets.com

[4] www.galileo-industries.net

[5] GSMWorld TAP

[6] Engblom, Katherina (january 2003). Location Based Services v3.10 GSM World, the wireless evolution, Permanent Reference Document SE23

[7] New Procedures Can Prevent Used GPS Satellites from Intersecting with Constellation