Difference between revisions of "Zhikai Xu"

| Line 150: | Line 150: | ||

===Habits of Customers are changing=== | ===Habits of Customers are changing=== | ||

====Name==== | ====Name==== | ||

<p></p> | |||

====Enablers==== | ====Enablers==== | ||

====Inhibitors==== | ====Inhibitors==== | ||

| Line 156: | Line 157: | ||

====Timing==== | ====Timing==== | ||

====Web Resources==== | ====Web Resources==== | ||

===New competitors are edging in=== | ===New competitors are edging in=== | ||

====Name==== | ====Name==== | ||

Revision as of 20:32, 27 March 2006

Object of the Future

FetchBook New & Used Books: Find the Lowest Price

http://www.fetchbook.info

I have found the website, FetchBook, which I thought most book buyers would benefit from.

When looking to buy a book on the web, this free service scans 126 bookstores and 60,000 sellers in just a few seconds, and finds the book stores with the lowest prices, usually at a discount of 30% - 80% off the list price.

FetchBook provides searching services for first, second hands books though most online book stores with high credit. It also enables third parties (individuals and vendors) to sell books on an online marketplace. Some book stores offer “Library” through FetchBook to the customers, which allow you to loan books instead of buying them. Customers can also get club memberships of some book stores through FetchBook, in which way more benefits including discounts and access to members’ only sections or activities are provided.

Like a broker and underwriter in financial market, FetchBook works on a higher level than the current online book stores and individual vendors. It provides the customers with an easy approach to book searching and purchasing on line. Book stores can also reach their potential customers more by FetchBook.

If FetchBook develops quite well in the future, I expect it to become

a rating and evaluating role in book sales besides just searching service provider.

What’s more, for other nondistinctive products, such as air plane tickets and

hotel booking, there is also possibility to establish one extra level above

individual online sales websites.

Research questions

Industry Profit analysis

The television network market consists of advertiser spending on broadcast and cable networks plus other sources of revenue that vary by region. In North America, the television network market comprises license fees paid by cable systems and satellite providers to basic and premium cable networks. In Europe, Middle East, Africa (EMEA), and Asia/ Pacific, it includes public TV license fees. Net advertising figures—made up of spending minus agency commissions and discounts—are tracked in EMEA, Asia/Pacific, Latin America, and Canada. Advertising in the United States is customarily reported with agency commissions included. The television distribution market is covered in a separate chapter. Multichannel advertising refers to advertising on networks that are accessed by viewers via cable (analog or digital), satellite, digital terrestrial television (DTT), or other means but that are not available in isolation from those services. Terrestrial advertising consists of advertising generated by free-to-air broadcast networks, even if viewers may receive such networks through a cable, satellite service, or DTT service.

I would like to give a little insight of the recent years profit situation of TV industry through some data of Australia, EU and US market.

Australia

The many ownership changes that occurred in the commercial television ector between the mid 1980s and the early 1990s caused abnormal losses during the period. However, the sector had returned to healthy levels of rofitability by the end of that decade. In fiscal 2001 and 2002, profit margins were reduced due to an unexpected decline in advertising revenue in calendar 2001. 2004 saw a modest rise in revenues, profit and margins. We can see more from the picture below

Broadcast profit margin before tax of Australian commercial television stations 1958-2004

EU

The meeting of experts on the reform of the instruments to encourage the European audiovisual industry addressed a profound research of financial situation in EU TV market.

Operating Revenues of various categories of radio TV company in the European Union

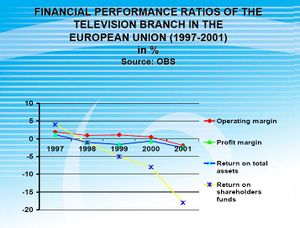

Financial Performance Ratios of the Television Branch in the European Union 1997-2001

Profit Margins of Television Companies in the European Union

We can see here that even though the operating revenues were steadly increasing during the past few years, the important ratios were not optimistic enough at the same time. What was consistent in all the years was advertising's strong position of creating profits.

US

The PricewaterhouseCoopers business firm's Global Entertainment and Media Outlook: 2004-2008 report predicts that by 2008, the industry will reach $174 billion. The fastest growing market is, not surprisingly, the United States with an annual growth rate of 7.5%.

US's is composed of big four in Broadcast and big three in Cable

Big Four in Broadcast

CBS Television Network

2004 Revenue: $7.76 billion

Number of owned stations: 39

Number of affiliates: 200

NBC Television Network

2003 Revenue: $6.87 billion

Number of owned stations: 29

Number of affiliates: 230

Fox Broadcasting Company

2004 Revenue: $4.55 billion

Number of stations owned: 35

Number of affiliates: 200

ABC Inc.

2004 Revenue: $11.78 billion

Number of stations owned: 10

Number of affiliates: 225

Big Three in cable

QVC Inc.

2003 Revenue: $4.9 billion

Households reached: 86 million in the U.S.A., 13.1 million in the United Kingdom,

34 million in Germany, and 11.6 million in Japan.

ESPN Inc.

2004 Revenue: $3.2 billion

Corporate Owners: Walt Disney Co. owns 80% and The Hearst Corporation owns

20%.

Home Box Office Inc. (HBO) & Time Warner

2004 Revenue: $3 billion & 2004 Revenue: $42 billion

Detailed information can be found in

http://www.turnoffyourtv.com/networks/revenueupdate04/revenue.html

Advertisement

In each case talked above, advertising has been among the most important sources of revenue during a long time in most locations of the world.

But currently the business of advertising is facing a variety of challenges and problems. Benchmarks for the two biggest national media, Nielsen ratings for TV, circulation metrics for magazines, need to be rethought and reset to meet marketers' needs. Changes in the advertising industry practices has been slow. Magazine executives called for circulation reform during the early '90s recession, when advertisements were slumping and they realized that circulation had been treated more like a cost than a profit center. Nielsen is moving ahead on areas of client complaint by providing customer service assistants, expanding its sample size and evaluating and testing new technologies. Yet given seismic shifts in TV technology, advertising and consumer lifestyles, Nielsen could be more vulnerable to competition this decade than in any period since the dawn of TV. In the end, key media metrics need to help measure what matters most is advertisers' return on investment. At the time, TiVo PVR had been on sale for less than two months, digital TV seemed far in the future, the emergence of interactive TV had been sidetracked by the Internet, and networks and agencies were in a bull market fueled by dot-com companies with money to burn.

Among major media, TV has no choice but to embrace change. It is the biggest advertising medium, accounting for more than $50 billion or about 23% of U.S. ad spending. TV revenue is booming, driven by strong demand from advertisers looking to spend to reach consumers looking to buy. But impending change is as clear as HDTV.

TV revolutions don't always come on schedule. Interactive TV, the next big thing of the early '90s, fizzled as developers and investors shifted focus to the Web. As we can see in the following two columns

Interactive Trend

Interactive television, which will enable consumers to order products, compete in game shows, and pay bills via their TV sets, has so far shown more promise than profits. But companies that have invested heavily in the technology hope to see that change soon. Recent developments are:

The FCC has allocated a portion of the broadcast spectrum to interactive television and will award licenses to investors who can show they'll be able to serve large markets. TV Answer, a private company in Reston. Virginia, wants to help contestants put their business plans together. The company's national ad campaign alerts potential customers to the lottery the FCC will use to pick winners. TV Answer wants to hook winners into a national interactive TV network, which includes land cell sites and a satellite. (See diagram for how the system would work.)

Interactive Network already provides subscribers in Sacramento, California, with a system that lets them play TV game shows just like the contestants, except the viewers compete privately with each other. Investors include General Electric's NBC and A.C. Nielsen, the ratings firm.

Further down the line, interactive TV may offer consumers a much wider range of products. Entertainment, consumer electronics, and computer companies including Apple Computer, Sony, and Toshiba are exploring ways to mesh their capabilities. For example, IBM and Time Warner (which owns FORTUNE'S publisher) are discussing ways to combine Big Blue's data-transmitting expertise with the media giant's cable TV systems, TV shows, and movies.

Interactive more influences the revenues of TV industry. Traditional commercials are changing into interactive marketing and on line marketing.

BMW's ongoing review for a new agency further highlights the central role interactive is playing for auto marketers. In a brief it sent to agencies in the review, the carmaker stated that "interactive represents a significant portion" of the account, and the winning agency would lead a redesign to make BMW's Web site "the best and most exciting automotive Web site."

Thinking of Profit in Internet TV

The Internet has progressed beyond being viewed as a purely direct-response channel to a key branding vehicle that can offer deeper consumer engagement than TV commercials — with more measurability. This has translated into a bigger role in client relationships.

With the fast-changing media landscape making consumers harder to reach through traditional methods, clients are involving interactive agencies earlier in the planning process and looking to them to take a more active role in setting strategy. As consumer habits shift, clients are in turn moving more money to digital initiatives, which in turn divert the main sources of traditional TV industry's profit into interactive on line advertisements.

Actually, Internet TV providers can be much more efficient in offering on line commercials to clients than traditional TV companies and creating up to date product of exploring innovative profit sources

The potential profits of Internet TV will not only come from the sources for old TV industry, but also variablility of mixed medias. For example, combining TV with blogs, on line shoppings, and etc.

Driving Forces

Sources of Profit are changing

Name

The sources of profit are changing in TV industry. As I analyzed in the research questions concerned with profit, the traditional ways of earning revenues in TV is advertisement, to be exactly, one way advertisement that audience in front of TV set passively accept whatever is showing on TV. Such kind of advertisement is confronted with a downside profit earning, that old TV industry can't back up itself with one way advertisement for a long time in the future. New profits may catch audience's eyes from television to other medias, like Internet TV, where the profits can be explored.

Enablers

Inhibitors

It could be other channels existing or potentially emerging that also provide interation with audience. For example, mobile TV is an alternative, which allows users to watch TV and provide fee of commertial services directly through mobiles. Even the enjoying feeling of watching TV can't be regarded the same as watching real TV through television set or PC, the convience and mature payment network exceed the situation in Internet TV. Whatever, mobile TV and Internet both need more technical maturity and market acceptance.

Paradigms

Innovative forms of profit are created based on more variable medias. Advertisements are diversified and audience participate and enjoy commertials while disclose their preference to ad makers and marketers to provide them more opportunities for new profit sources creation.

Experts

Supported by front edge advertisement makers, who are running interactive commertials to get large margin.

Timing

The change in profit resources is under way nowdays. It is probable within a few years that a quite larger amount of advertisements is distributed through more variable medias and in the form of two way communications.

Web Resources

Please refer to my WIKI of profit research question in Internet TV.